Learning Outcomes

After this course, participants will be able to:

- Describe how economic and marketing principles support growth opportunities in the hearing aid market.

- Describe how professional services rendered, and not price is the primary factor in the procurement of audiology services and technology.

- Discuss strategies that increase audiology awareness, service and technology adoption rates, and, ultimately, total revenue.

Introduction

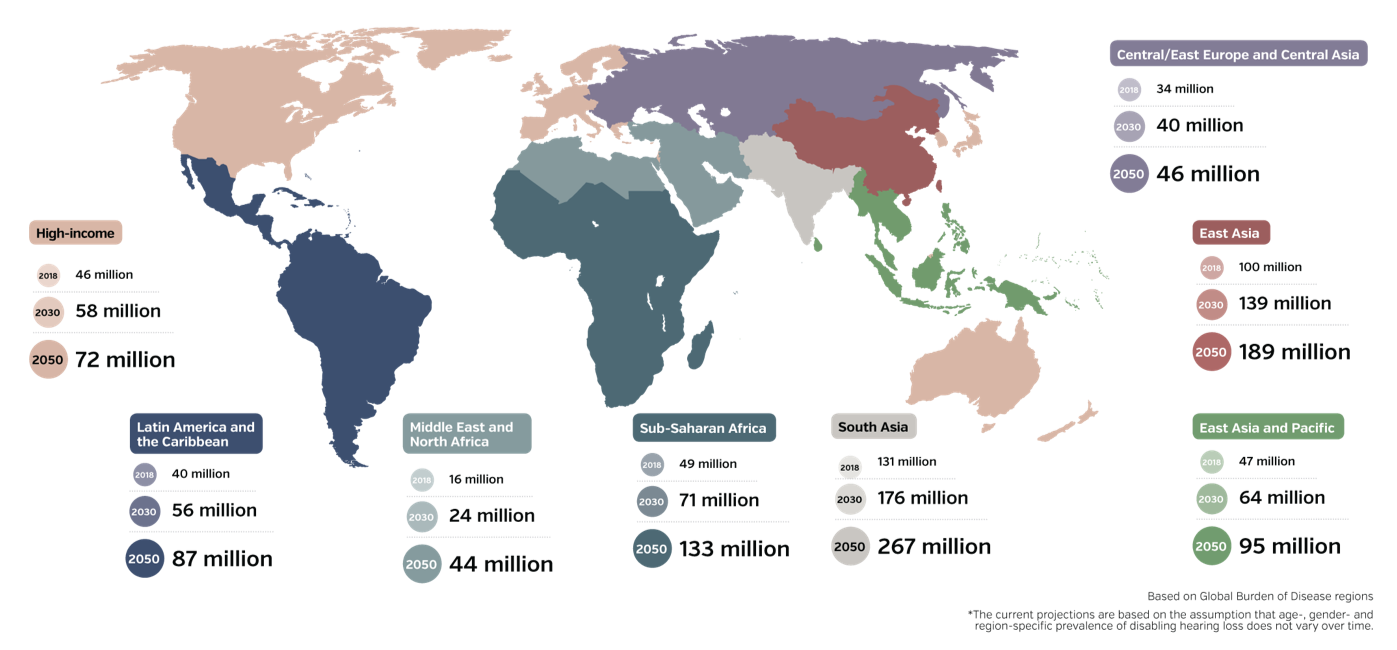

The environment in hearing healthcare is changing rapidly. These changes will have a profound influence on the profession, our scope of practice, the service delivery that we provide our patients, and the technology that we deliver to these patients. My aim today is to apprise you of these changes and provide solutions that can be implemented clinically and in the competitive market. Figure 1 shows the number of people who have hearing impairment worldwide today and projected out until 2050 (World Health Organization, 2018). You'll notice that there is an increase over time in the number of individuals who have hearing loss.

Figure 1. Projected number of people with hearing loss in different world regions until 2050. (World Health Organization, 2018).

When we look at this data as a function of the number of individuals that we can serve, we call that patient flow. The patient flow that we have is remarkable, meaning that there are ample people with impaired hearing that we would benefit from audiological services and technology. The question now becomes from these people, how many are we helping?

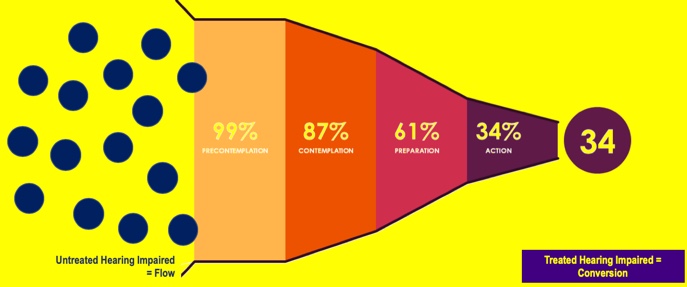

In order to achieve a better visual representation who we are helping, I took global data from the World Health Organization and applied the Health Belief Model (Rosentock, 1966), shown in Figure 2. The blue circles on the left represent the number of individuals that are entering the market as untreated. In the light orange area, 99% of these individuals who realize that they're having hearing difficulties are in the pre-contemplation phase. Of this 99%, 87% are inquisitive enough to recognize that they probably need some help (entering the contemplation phase). From there, about 61% of these people visit a hearing healthcare specialist to discern whether or not they, in fact, have a hearing impairment (preparation phase). Once we've tested their hearing, we lose another 27% and we are left with 34% of people who actually receive treatment. For every three patients, we see we're only treating one. That treatment is called conversion (synonymous with adoption, uptake, and market penetration). The main point is that we have lots of individuals entering the market, and only 1/3 of them, ultimately, end up being treated.

Figure 2. Patient flow and conversion - global.

Clearly, we need to address and identify some of the factors that are impeding us from helping these individuals, and figure out what can we do to improve that.

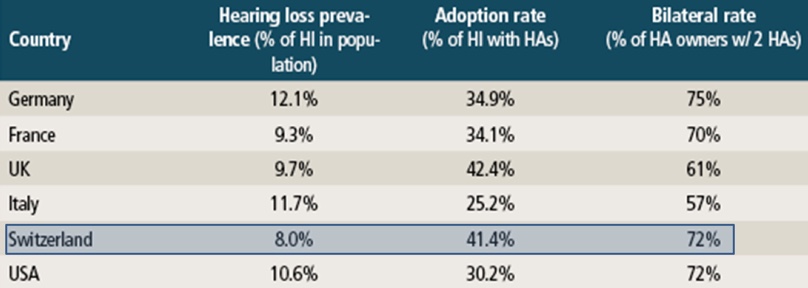

Global Patient Uptake

It is a common notion that price is a primary factor why individuals don't enter the hearing aid market. Keeping that notion in mind, let's take a look at the graph in Figure 3 which shows the hearing loss prevalence in different European countries (Hougaard et al., EuroTrak 2016). We can see the percentage of individuals who have hearing loss in each country, as well as the conversion rate, or adoption rate. I'd like to draw your attention to Switzerland. You'll notice that 8% of their population has a diagnosis of hearing loss or hearing impairment, and yet only 41.14% are being treated. What's interesting to note is that in Switzerland, the diagnostic hearing testing, treatment, and hearing aids/devices are free. In a free market where all you have to do is make an appointment and walk through the process, only 41% of individuals are seeking treatment. Clearly, there is a disconnect if nearly 60% of individuals aren't being treated. That 60% is the population we're going to examine for the purposes of today's presentation.

Figure 3. Global patient uptake.

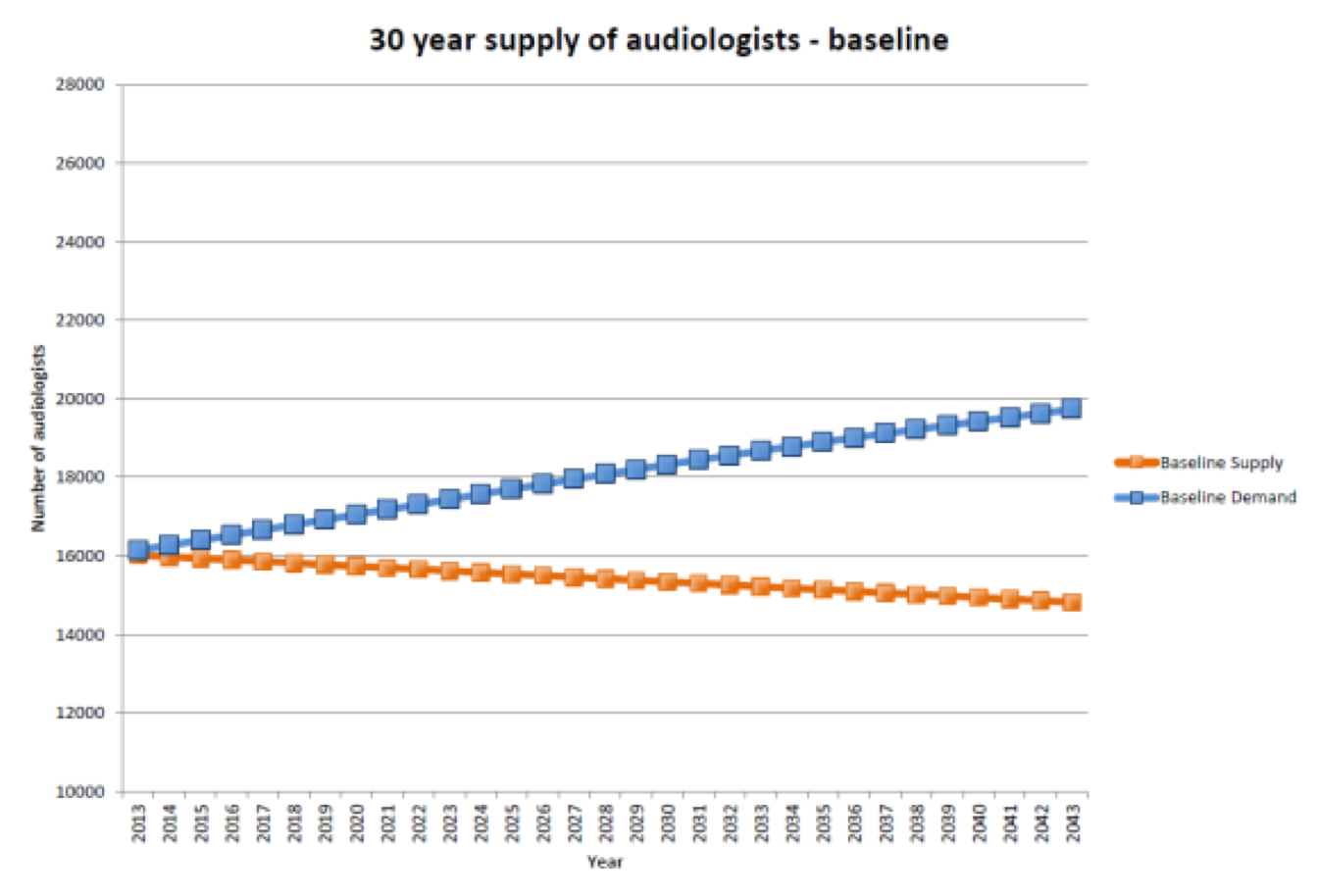

The next graph we're going to look at is from Windmill and Freeman (2013). This graph shows the supply side as it relates to hearing aid dispensers in the marketplace (Figure 4). These are projections over the next 30 years. The blue line represents the demand for audiological services, or the patients seeking treatment. As I demonstrated earlier on the World Health Organization graph, the demand is going to increase over time. The orange line that is moving downward represents the number of audiologists and hearing care specialists that are available to treat patients. According to these projections, over the next 30 years as demand for treatment increases, the supply of audiologists decreases. In other words, even if every single audiologist were available to test individuals, we could not test everybody in the market. That statistic has become a point of contention for legislators and other market players today.

Figure 4. Supply of audiologists vs. demand for treatment over the next 30 years.

New Age in Health Care

Given that price is not the primary issue, and given that we don't have enough hearing care professionals to test and treat the individuals that are entering the marketplace, there has been a realignment in the healthcare space. This new alignment is predicated on three concepts:

- Improving the patient experience

- Promoting self-care (i.e., getting the patient to take care of themselves)

- Saving time (i.e., reducing the number of visits that a patient needs to be seen by an audiologist so that the audiologist or hearing care specialist can see other patients)

Retailization of Healthcare

To meet these three aims, there has been what I refer to as a "retailization" in healthcare in general, including hearing healthcare. For example, if you were to go into your clinic to be treated for a sinus infection, the likelihood of you seeing your primary care physician is very small. You're more likely to see a nurse practitioner or a physician's assistant. Another option might be for you to visit a retail clinic, such as at a Walgreens Pharmacy or a Minute Clinic inside of a Target store. Similarly, you can now get your hearing tested at CVS Pharmacy, and Walmart is getting ready to roll out in-store hearing testing. Sam's Club and Costco both already offer hearing care services in their stores.

In addition to walk-in retail clinics, there are online healthcare options for the treatment of basic medical conditions (e.g., VirtuWell and TeleDoc). In the eye care industry, Warby Parker offers online eyewear. In the dental industry, SmileDirectClub offers invisible braces shipped directly to your home. Similarly, as it relates to the hearing industry, there is a smartphone hearing screener called hearScreen, which was developed by a group in South Africa. It is endorsed by the American Academy of Audiology. The screener allows individuals to test their hearing. The individual can submit the data from their hearing test to a provider who will contact them and treat them if the hearing loss is severe enough and if the patient is willing to come in. It's sort of a referral service.

Direct-to-Consumer Products

Over the last few years, you have likely heard about direct-to-consumer or over-the-counter hearing products. As of the date of this webinar, these products have not yet been defined by the Food and Drug Administration. However, there are several personal sound amplification products available (PSAPs). The emerging PSAP market is going to dictate to some degree what the OTC market is going to look like, in terms of its viability and its service deliverables or value propositions.

There are three categories of PSAPs that we've been able to assess:

- Preset interface

- Customizable interface

- Expert interface

Preset interface. Figure 5 shows an image of a PSAP that has a preset interface. It looks similar to a BTE or a RIC. It has two listening modes or two preset frequency responses that are available. You have the option of programming the frequency response for each of these listening conditions. It has a rocker switch for adjusting the listening modes. These devices typically cost around $100 or less. There is no audiogram needed and it has very limited support if you were having issues and needed to call in for assistance.

Figure 5. PSAP with preset interface.

Customizable interface. A second model of PSAP that's available is known as a customizable interface (Figure 6). These devices look more like RICs. An audiogram is needed in order to fit these devices, which is typically performed online or through an app. Based on the audiogram, you develop a profile of the settings or environments in which you want to have frequency responses. You can pay for additional support and then you're able to adjust the device using an app.

Figure 6. PSAP with customizable interface.

Expert interface. The third level of direct-to-consumer PSAP devices is known as the expert interface (Figure 7). These devices look and feel more like hearing aids. The product in Figure 7 (Nuheara) does not look like a hearing aid, however, some products that will be entering the market do resemble RICs. With the expert interface, you take a hearing test online or through an app to obtain an audiogram. At that point, you are able to go in and fit the device and add expert like features such as directionality, noise reduction, etc. You also have the ability to connect to a streamer, which is again very similar to traditional devices that we dispense in the clinic.

Figure 7. PSAP with expert interface.

You can purchase these PSAPs online through retailers like Amazon, or directly through the manufacturer. They are not FDA approved. The FDA approved devices will be called over-the-counter devices. We have yet to see what those devices are going to look like.

How Viable Are These Products?

How viable are these products? We can assess their viability from an electroacoustic standpoint, as well as from a behavioral standpoint.

Electroacoustic factors. I am the editor for the economic section of Hearing Health & Technology Matters (https://hearinghealthmatters.org/hearingeconomics/). In August of 2017, I wrote an article titled "Relationship Between OTC Price and Behavioral Performance: A Guiding Light". In my article, I cited a study by Calloway and Punch where they looked at devices electroacoustically as a function of price (2008). They found that the lower the cost of the device, the less the product was able to meet the electromagnetic compatibility (EMC) standards that we use today. The higher the price of the device (roughly $300 or $400), the more likely the device was to be compliant with today's EMC standards. There is an electroacoustic relationship between the cost of a personal sound amplification product and its performance.

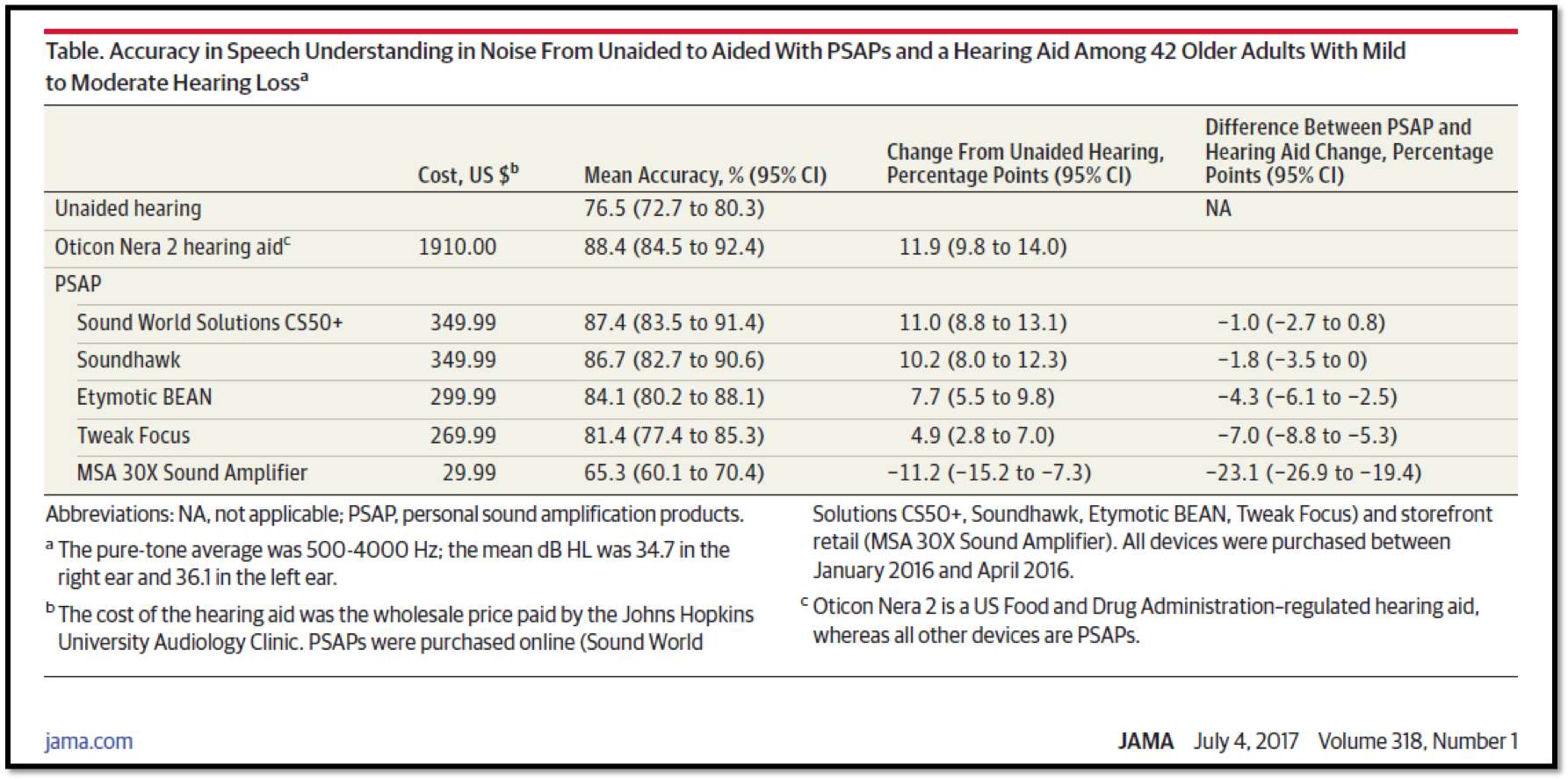

Behavioral factors. We can also see the relationship between the cost of the device as a function of behavior. In a 2017 study conducted at Johns Hopkins University, they tested five different PSAPs of different price ranges (Reed et al., 2017). They used 42 older adult participants with mild to moderate hearing loss. Their aim was to measure the subjects’ performance on a speech understanding in noise task using five different PSAP devices and compare the results to their performance using an Oticon traditional hearing aid (Oticon Nera 2).

Figure 8 shows a summary of the results. The accuracy with the Oticon device is 88.4%. On the same task, the Sound World Solutions device (priced at $350) resulted in a score of 87.4%. That is about a 1% difference, which is not statistically significant. Using the Soundhawk device also priced at $350, the subjects’ performance is not that much worse. You'll notice that as the price of the PSAP decreases, performance also decreases. As we look at these personal sound amplification products, the price and the performance electroacoustically and behaviorally are related where higher prices tend to have better performance and lower prices tend to have lower performance.

Figure 8. Speech understanding in noise aided with PSAPs vs. Oticon Nera 2.

Another category of product that will be coming into the market has to do with pharmaceuticals. There are different pharmaceuticals that will be available intended to prevent hearing loss, cure hearing loss, or improve cognitive processing ability. In the first category of prevention, there is a product called Otoprotection (based on Kathleen Campbell's work). This is a pill that you can take before you go into a noisy environment and it will prevent damage to your hearing cells. In the curing category, there are things like Gene Therapy. By taking these pills, we can regenerate the hair cells to stave off hearing loss. Finally, in other cases, you can take pills in order to improve your cognitive processing ability. These are the emerging areas in which we're going to see interesting changes in our hearing healthcare sector.

Market Disruption: Impact on Professionals

All of these new developments and innovations are going to have profound effects on the products that are available in the marketplace. First, it's going to change the service delivery model through which the consumer enters and exits our marketplace. Furthermore, it's going to change how practitioners will practice and run their business. Ultimately, it's going to change how hearing care professionals get paid for the services and the products delivered.

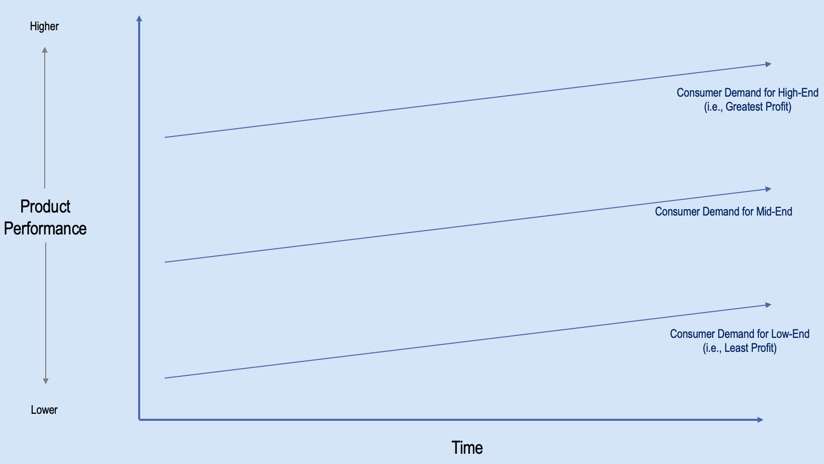

These industry changes lead us to the concept of disruption. From a product standpoint, disruption is when a new product enters the market at a lower price point. To illustrate, take a look at the graph in Figure 9. On the y-axis, we have product performance. On the x-axis, we're looking at this over a function of time. The three blue lines represent consumer demand for certain products. The top line represents the demand for higher-end products, which is where the most revenue is generated in a practice. The middle line shows the demand for middle-range products, and the economy products (those that generate the least profit) are on the bottom.

Figure 9. Consumer demand for high-end, middle-end and low-end hearing products.

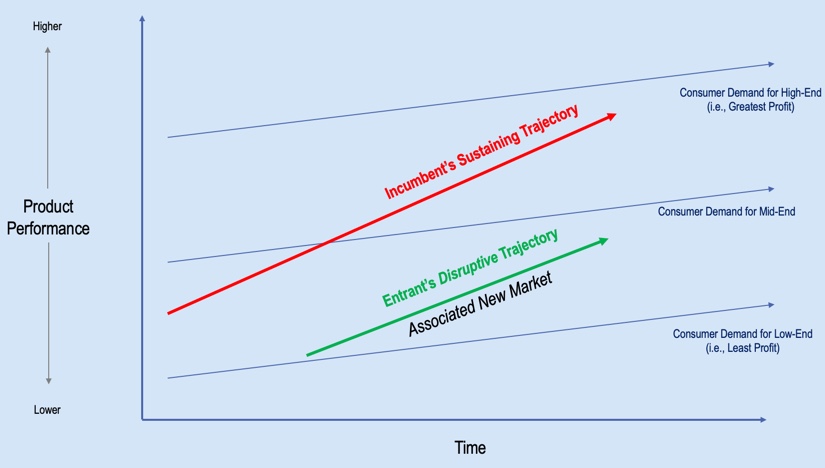

If we take these three bars, and we convert them into a single line, we can show a trajectory for this market, represented by the red line in Figure 10. If you look at some of the units sold, as reported in our trade journals, you'll notice that the trajectory of units sold over time has been increasing. It becomes disruptive when you have a new group that enters this market at a lower price point. This disruption (represented by the green line) comes in underneath the sustained or the incumbent trajectory at a lower price point.

Figure 10. Incumbent's sustaining trajectory vs. entrant's disruptive trajectory.

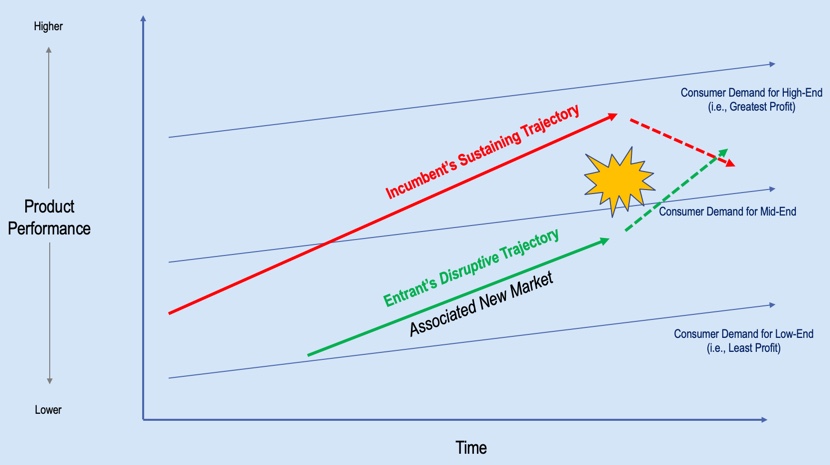

At some point, there is going to be what we call a "big bang" (Figure 11). There will be a reduction in the traditional hearing aid market and there will be an increase in the new market. That's where that disruption occurs. We could potentially see this in the pharmaceutical realm, we could potentially see this in the product realm as OTC hearing aids and PSAPs ramp up. It will be interesting to see how all of this plays out, but this is the expectation that will enter the market.

Figure 11. "Big bang" disruption.

How does this market disruption affect us as professionals? The contemporary role of the hearing healthcare provider is deeply tied to technology (e.g., hearing aid devices and diagnostic equipment). The cost of the disruptive technology will approach zero, which is an unsustainable business model given “traditional” business practices. In addition, the disruption causes the creation of new market segments, several of which will require “traditional” business practices to re-think their content and messaging, their value proposition (i.e., hearing aids vs. improved quality of life), their pricing structure, as well as to create a new business case (i.e., service-based).

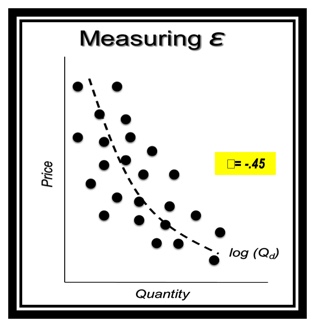

Pricing

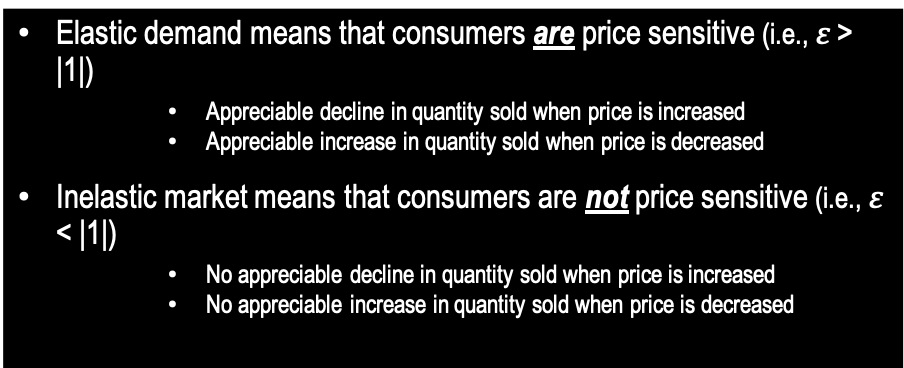

Pricing plays a big part in this disruptive component. If we look at the traditional market today, the demand for this market is what we would call "inelastic" (Aaron, 1987; Lee & Lotz, 1998; Amlani & De Silva, 2005; Amlani, 2010). That means that it is not price sensitive. If we do an analysis of the data that's available in the market today, we come up with what we call a demand function of -.45 (Figure 12). We arrive at this number by taking data for different products at different prices, and if we run a non-linear regression through that data set, it has a downward slope, which is where we get the negative number. We use these values to determine where we are in the pricing cycle. If the number is greater than the absolute value of one, we now have a price-sensitive market. In that case, as we increase our price, we're going to lose a ton of people. As we lower our price, we're going to gain a ton of people. This is a market that we've seen in fast food. If you look at value meals and you look at these products under $1 or $2, the idea is to reduce the cost to sell more. That's a price-sensitive model.

Figure 12. Elastic vs. inelastic demand.

In contrast, the hearing healthcare market (and healthcare in general) is an inelastic or not a price-sensitive market. In other words, if you increase your prices, you're not going to lose that many people. Conversely, if you lower your prices, you're not going to gain that many people. Price is not the primary factor in this equation, which I will demonstrate coming up, but first, let's look at how these elastic and inelastic markets affect your revenue stream.

Referring back to the demand function graph in Figure 12, I can look at pricing and quantity at various points on the graph. I can look at higher-end prices, I can look at the midline prices, and I can look at the economy line prices. Now, if I have elastic demand where things are price sensitive and I raise my prices, I'm going to lose people. However, if we reduce prices, I'm going to increase my revenue. In an inelastic demand, if I raise prices, I'm going to increase my revenue stream, even though I'm going to lose a few folks. If I reduce prices, I'm actually going to end up losing revenue (Figure 13).

Figure 13. Elastic vs. inelastic demand. (Amlani, 2009).

Market Cannibalization

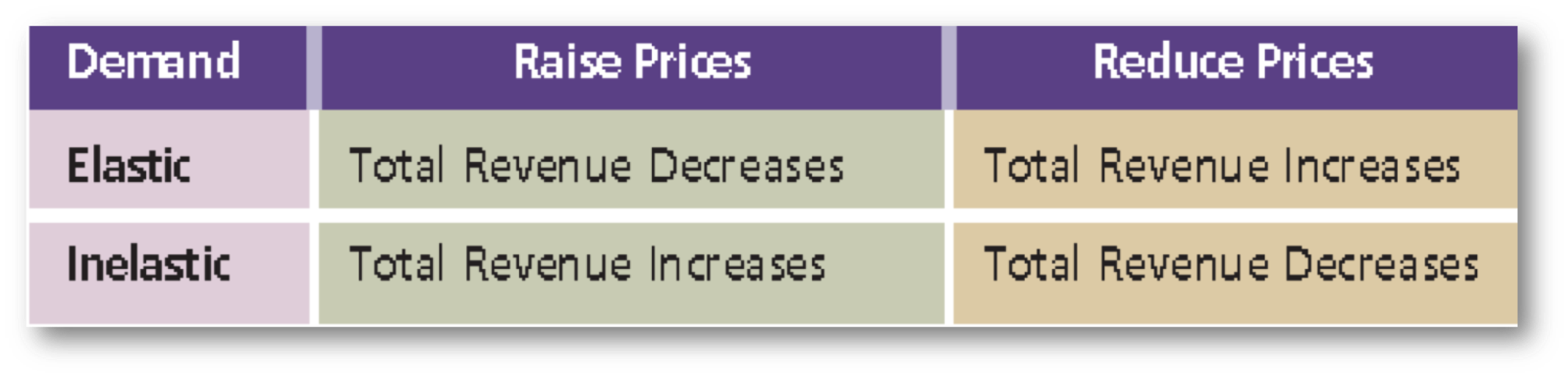

If we look at this data trend (Figure 14; Hosford-Dunn & Amlani, 2016), you will see that from a retail standpoint, the hearing aid market has bought into inelastic demand function. If we look at low-end products, we want to increase our prices, and by increasing our prices, we have an increase in our revenue stream. For high-end products, we want to reduce our prices so that we can increase our revenue stream.

Figure 14. Inelastic demand in the hearing aid industry at retail prices (Hosford-Dunn & Amlani, 2016).

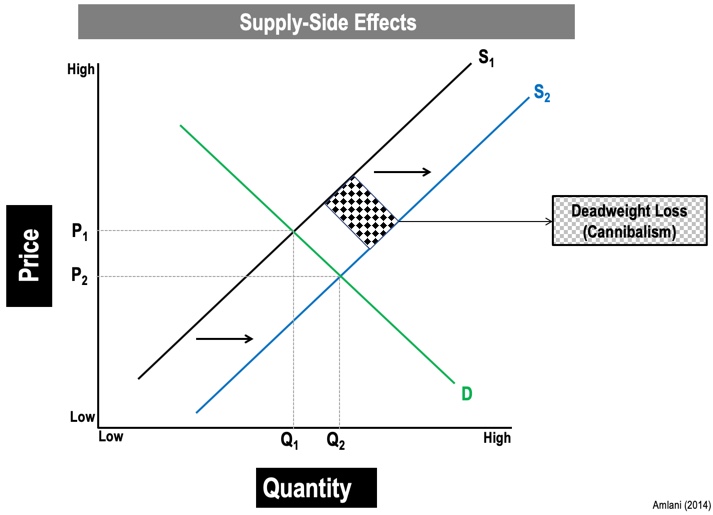

If you don't understand this pricing structure well, you could be cannibalizing your revenue stream. In Figure 15, S1 is your supply function, and D is the demand. The D is the individuals coming into the market; the supply is where you are actually providing a service and technologies to your patients. Again, we would find the price and the quantity demanded and come up with a value. If you choose to subscribe to reducing your prices in order to gain more people, theoretically you're losing income. That's where pricing cannibalization occurs if you don't have the right pricing structure. We've written about this topic in various journals and that literature is available freely to you. Just type my name and price elasticity into a search engine and you'll be able to find the formulas to calculate that (Hosford-Dunn & Amlani, 2016).

Figure 15. Supply side effects (Amlani, 2014).

Another way that clinicians and practices tend to cannibalize themselves is the way in which they price and market their products. For example, if I decide that I'm going to take a set of devices that traditionally retail for $1900 and advertise them in the newspaper for $900, I'm cannibalizing my revenue stream because I'm not going to gain anyone because the market is not price sensitive. The same thing is true if we look at these over-the-counter or direct-to-consumer products that are going to be entering the market. You don't have a huge markup on these, it's going to be based on your service delivery model. You're going to be racing to the bottom in order to compete for your revenue stream. If you play in this market, you're going to end up cannibalizing your practice and putting it in jeopardy, in terms of a revenue stream.

The other way that we have historically cannibalized our market is by giving away services for free. The free hearing test is a prime example of that. Giving away free hearing tests makes it difficult for the provider and the practice to hold up its integrity. Let me explain. If I'm giving away free hearing tests, it's difficult for me to go in and itemize and unbundle services. The consumer is going to ask why we are nickel and diming them for these services when we just gave away a free hearing test. The other way that the free hearing test is detrimental is that it diminishes the person's predisposed perception of the practice. The likelihood of the individual purchasing a product at a higher-end or a mid-end goes away and you've now anchored these individuals to either buying economy line hearing aids or looking for other venues such as your retail box outlets. From a psychological standpoint, this is detrimental to the profession. (The reader is referred to Abel & Coverstone, 2019)

Yet another way in which we have hurt ourselves professionally is the fact that we don't perform and provide a standard practice level. I'll give you an example. There is existing data to suggest that not every practitioner who fits hearing aids provides pro microphone measurements or real ear measurements. That's detrimental. As I walk from clinic to clinic, each clinic's practices should be the same. When patients see that that's not happening, then again, we're lowering the standard which then lowers their predisposition towards our services that are provided. I encourage you to read an elegant article on this topic written by John Coverstone in the March 2019 Hearing Review. It is titled "The Need for Standards in Audiology".

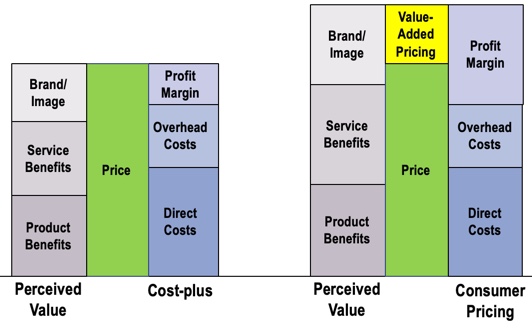

Cost-Plus vs. Value-Based Pricing

When we talk about cannibalizing, we can look at it from a pricing standpoint, or what we're leaving on the table. Most practices use what we call cost-plus pricing (Figure 16; Amlani, in press). In cost-plus pricing, the selling price is determined by adding a specified markup to a product's unit cost. When you do this, you are leaving out the value that you as a service provider are bringing to the table. By doing that you are cannibalizing your revenue stream, within your practice. In contrast to cost-plus pricing is value-based pricing. With value-based pricing, the selling price is based on the service and product benefits perceived.

Figure 16. Cost-plus (left) vs. value-based (right) pricing (Amlani, in press).

Here is a clip that will explain it in a different way:

If I had a practice with $100,000 in gross revenue annually and I had an opportunity to reduce my costs by 20%, I'm now saving $20,000. The flip side of it that is I could turn around and do some things differently in my clinic, providing various services maybe retooling the way that I schedule my patients, knowing which marketing levers to pull and I could increase my profits by $100,000. The question becomes, "Do I want to invest my time and my energy in reducing my costs by $20,000? Or do I want to take that energy and try to improve my practice by $100,000?" These are decisions that clinicians have to consider.

Improving Revenue Stream

Next, we are going to think about how we can improve our revenue stream and how we can be competitive in the market by looking at service delivery models, evaluating things that we do correctly and things that we can improve upon. Then, we will examine some ways that you might be able to generate additional interest in your clinic.

In order for hearing care professionals to remain competitive with the impending OTC and PSAP products coming on the market, we need to differentiate ourselves with value. As an example of a successful value proposition strategy in another industry, let's look at Starbucks. A cup of Starbucks coffee is about $4. I can get a similar cup of coffee somewhere else for $1 (e.g., McDonald's, a convenience store). Why is it that Starbucks has been able to capitalize on this market and the consumer is willing to spend four times as much for a similar kind of coffee? It has to do with the experience that the customer has when they enter Starbucks which is very different than when they enter McDonald's. Similarly, in the hearing industry, we need to differentiate ourselves with value propositions and not price in order to be competitive in this new market.

How do we achieve success amid market disruption? There are several measures we can take. First, we need to rethink our content and messaging. In addition, we need to create a new business case through service-based initiatives. We do that through value propositions, such as using different terminology and changing how we talk about certain concepts in our practices (e.g., "improved quality of life" vs. "hearing aids"). Finally, we need to consider appropriate pricing.

Adding Value to the Patient Experience

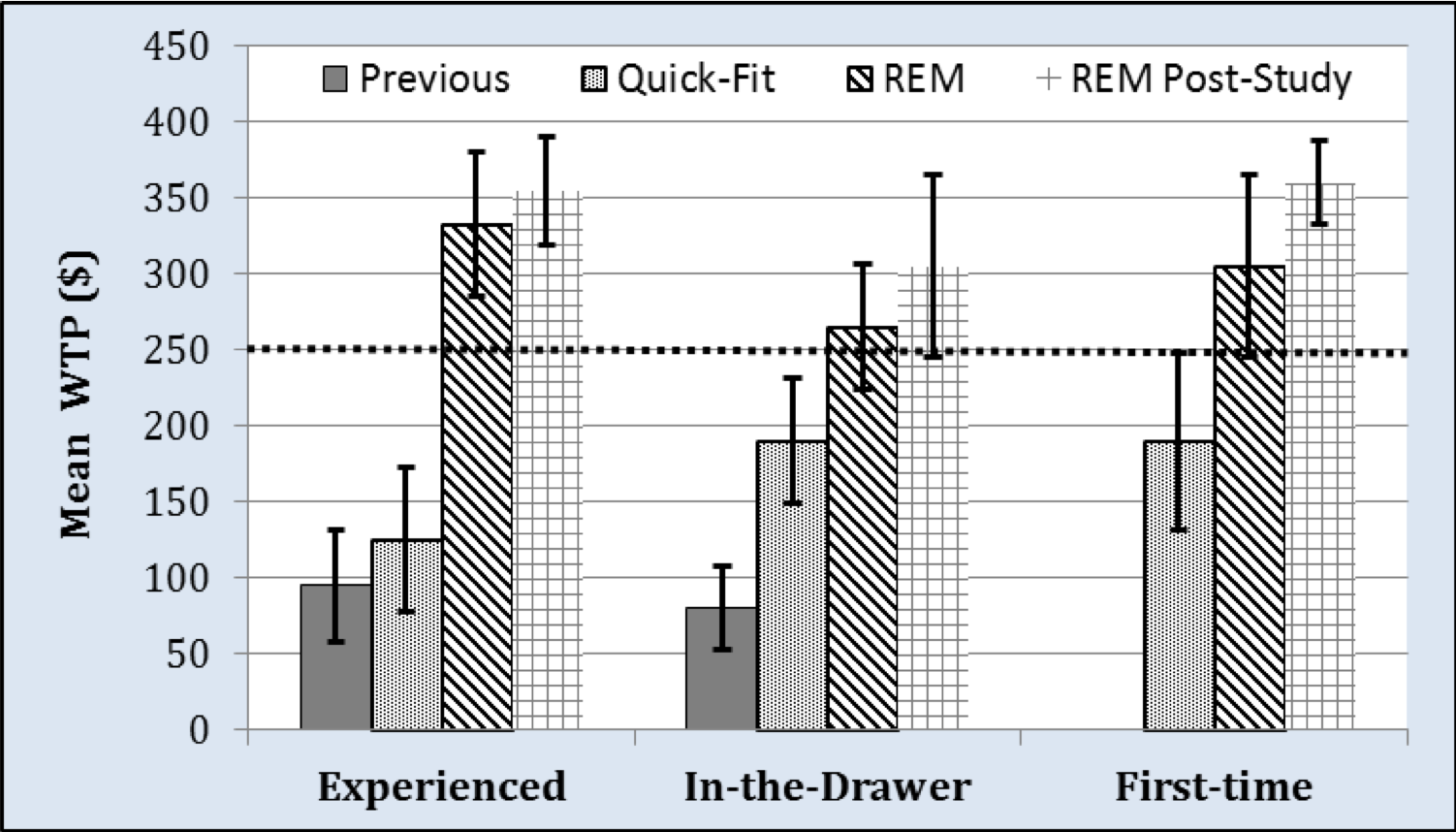

In 2016, we wanted to assess the value of providing real ear services to patients (Amlani et al, 2016). Every patient was told that real ear costs roughly $250 an hour to perform. We had different groups of individuals that were asked to rate their experience based on the service they received. The data in Figure 17 shows the responses of each group (based on different criteria) and their willingness to pay (WTP). A consumer's willingness to pay is a psychological measure which indicates the maximum price at or below which a consumer will buy a product or service.

Figure 17. Willingness to pay (Amlani et al, 2016).

The participants in this study fell into different three different categories of hearing aid users: experienced, in-the-drawer users and first-time users. The groups in each level of hearing aid experience were asked their opinions about the different services that they received. Some of the patients had been tested previously by a provider. We asked them to rate their service based on what they could recall. Other patients received a quick-fit (using the manufacturer's first fit algorithm), where the device was not fitted 100% as it should be. Finally, there were also patients who received real ear measurements (REM).

The first two groups (those who were fitted previously and those who received a first fit) rated their willingness to pay far below the $250 price anchor. However, patients who received the real-ear measurement (along with counseling and explanation of benefit) had a higher perception of their clinician and rated their WTP much higher. Clearly, we can see that adding value to the patient experience is a positive thing (Amlani et al., 2016).

The Path to Purchase

In an effort to find out what factors are most important to patients (e.g., trust, empathy, counseling), we turned to the literature and looked at various systematic reviews (Ferguson et al, 2017; Meyer & Hickson, 2012; Knudsen et al, 2010). Thus far, we have not been able to conclusively determine what those factors are through looking at these systematic reviews. Another possible solution to determine which factors are important to patients might be to use models of health behavior. These are psychological models that assess behavior (e.g., Theory of Reasoned Behavior, Health Belief Model). However, the literature suggests that models of health behavior do not work well in hearing healthcare. The question then becomes, "How can we improve the value proposition for hearing healthcare providers so they can meet the needs of the patient in this competitive market?"

Previously, I talked about the retailization in the hearing device marketplace. Using that as our framework, we asked the question, "Do our impaired listeners not view their hearing difficulties as a medical condition, but do they look at it as a consumer decision?" In other words, do they perceive hearing loss not as a medical issue that can be treated, but as something that can be aided by a product they can seek out and purchase? Rather than a change in behavior, they are seeking a strategy to overcome a state. Today's consumer has lots of different options with regard to hearing care. Online testing and product service delivery are available through websites such as Listen Lively (www.listenlively.com). Consumers can walk into a big box store (e.g., Costco) and procure hearing care services and products. They can go online and simply fit themselves, which is an option through the direct-to-consumer channel that we discussed earlier.

Generational differences. Another factor that is important to understand involves generational differences and pathways to purchasing for different demographics. If you have been in the field of hearing care for any length of time, you have worked with individuals from "the silent generation". These are older patients that need explicit instructions to follow steps A, B and C. When you explain to them that if they follow those procedures, their hearing will improve, they will do exactly as you tell them. In contrast, however, the Baby Boomers, the Gen Xers, and the Millennials are more technologically savvy. They're going to question what it is that you're asking them to do. Because of these questions, it's going to be imperative that we have appropriate responses ready so that they become compliant. It's also worth noting that Millennials have less money to spend on technology than Gen Xers and Baby Boomers. As such, when you are trying to demonstrate value to a Millennial patient, price will be a consideration that you will need to carefully address in order for that person to adopt your services and your technologies.

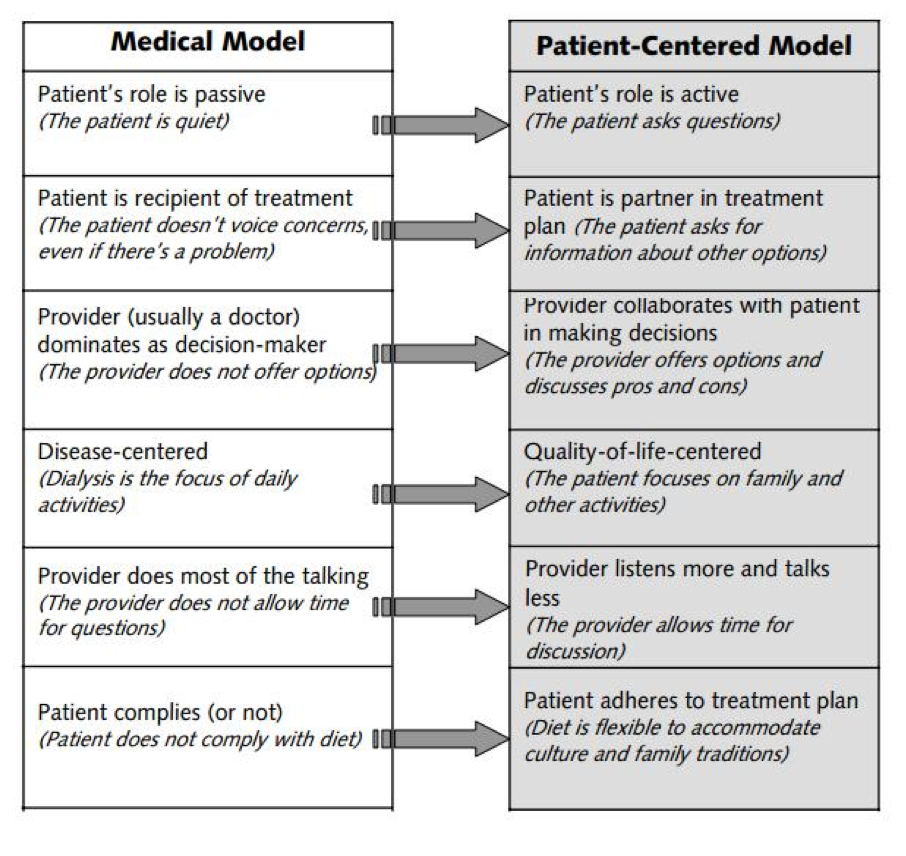

Medical model vs. patient-centered model. In general, healthcare is moving from a medical model (i.e., a "Do as I say" model) to a more patient-centered model (i.e., shared decision making). This is where the patient is going to have more input into any treatment or therapy they are going to receive, how they're going go about it and under what framework they're going to do it. As we examine these changes in state of behavior, and as we consider the field of audiology, we need to ask ourselves if we, as hearing care professionals, have moved from this medical model to a patient-centered model (Figure 18)?

Figure 18. Medical vs. patient-centered models (https://devontexas.com/2013/08/21/dialysis-and-patient-centered-care-2/).

Desired state vs. actual state. In order to look at this more in-depth, I used a consumer decision model by Blackwell (Blackwell et al., 2001). The most important component of this model is need recognition. In other words, "Do I need to act on this in order to improve my state?" Need recognition is based on two basic principles: desired state and actual state. Actual state is what I know about myself today. Desired state is where I want to be later on. For example, if I'm currently a lazy, inactive person wanting to run a marathon, how do I go from being a couch potato to running 26 miles?

First, we need to look at some different scenarios:

- Desired State > Actual State: If my desired state exceeds my actual state, then need recognition kicks in. I realize that I need to take action. At that point, I'm going to evaluate myself from a motivational standpoint, from an ability standpoint, and from an opportunity standpoint to ensure that I can expend the time, energy and resources to reach my goal. In the case of someone with hearing difficulties, the likelihood of amplification or treatment increases when the value proposition is there.

- Desired State < Actual State: When the desired state is less than the actual state, the likelihood of this compliance and this value proposition meeting an opportunity is going to decrease. In a person with hearing difficulties, they may feel satisfied with their current state and they may not be motivated to seek amplification.

- Desired State = Actual State: When the desired state equals the actual state, the likelihood of this compliance and this value proposition meeting an opportunity is going to decrease. In a person with hearing difficulties, they may feel satisfied with their current state and they may not be motivated to seek amplification.

In general, the audiology profession is stuck in either the Desired < Actual or the Desired = Actual state. We are not providing the right information and value propositions to our patients. We are not sharing this information in such a way as to move our patients from their actual state to a desired state.

Consumer Decision Model: Methodology

To demonstrate, I'm going to share some information from a study that we conducted (Amlani et al., in press). We were fortunate enough to have the opportunity to work with the AARP and we were able to solicit responses from 618 adults who, of their own accord, had made the decision to get their hearing tested by an audiologist for the very first time. Over the course of about 16 or 17 months, we collected the data. We asked these individuals to complete a survey two weeks prior to seeing their audiology provider, having never visited one previously. We also had them complete a survey two weeks after they had seen the provider. That way, we were able to ascertain their desired state (i.e., what they expected to receive) as well as their actual state (i.e., what was received).

When we conducted this study, we also realized that predisposition is related to the environment in which you enter. As an example, let's look at the food/restaurant industry. Your expectations are going to be different if you walk into a fast-food restaurant, as opposed to a high-end restaurant that requires you to wear a coat and tie or an elegant dress. It's a similar comparison here. We asked individuals the following question:

In your opinion, a hearing healthcare provider is best classified under the heading of:

- medical

- rehabilitation

- consumer electronics

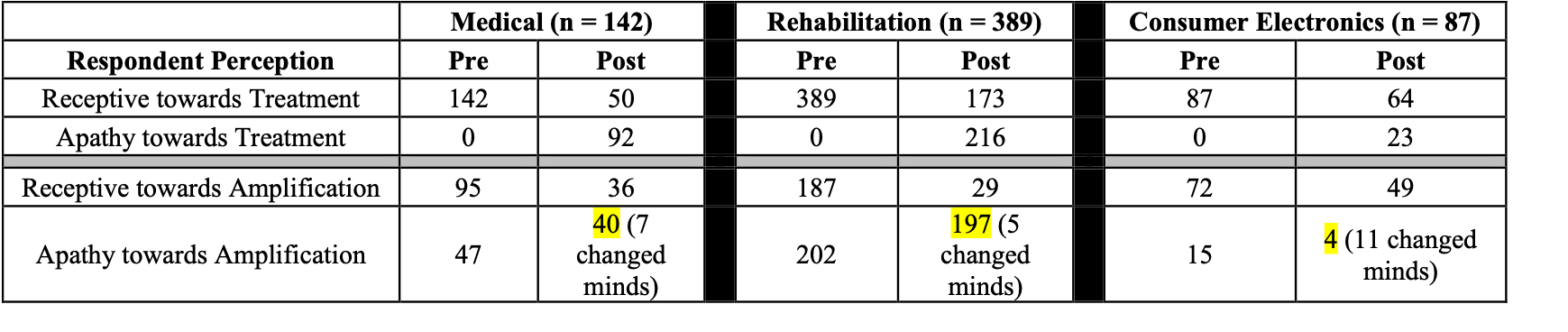

Pre-appointment, we also asked them about their interest in amplification. Of the 618 participants surveyed, Figure 19 shows a summary of their pre- and post-appointment survey responses.

Figure 19. Comparison of pre- vs. post-appointment responses.

Let’s look at the responses of the 142 individuals who responded that a hearing healthcare provider is best classified under the medical profession. Pre-appointment, 142 of them indicated that they were receptive toward treatment; post-appointment, that figure went down to 50, and 92 of them indicated apathy toward treatment. Moreover, pre-appointment, 95 of these individuals indicated that they were receptive toward amplification; post-appointment, this figure dropped to 36 people, and 40 of them declined amplification entirely. This decline indicates that as consumers or patients are entering the practices, they have a certain set of expectations. However, due to a number of different variables, their expectations are not being met because they perceive that the value proposition isn't there. In effect, their desired state is decreasing, which is one reason that we're not seeing the conversion rate that I showed you earlier.

In contrast, of the 87 respondents that felt a hearing healthcare provider fell into the consumer electronics category, 64 of them remained receptive toward treatment post-appointment, and 49 of them indicated that they were receptive toward amplification. This indicates that expectations are being met because, in a consumer electronics environment, patients have lower service delivery expectations than in a medical environment.

Finally, 389 people responded that they perceived a hearing healthcare provider should be categorized as being in a rehab setting. Of those 389 respondents, only 173 of them were still interested in receiving treatment post-appointment, and 216 of them indicated apathy toward treatment. This decline of treatment/amplification indicates that these patients were turned off by something they experienced, causing them to perceive that the value was not there. We have all these individuals that were initially interested in amplification and we've lost them. How do we improve customer loyalty, along with improving our value proposition?

Improving Clinic Conversion Rates

As we begin to wrap up the presentation, I'm going to offer some ideas that you can implement in your clinic that may help improve your conversion/adoption rate.

Change Terminology

One of the ways we can improve our conversion rate is to change our patients’ perception about hearing loss. In 2017, Curtis Alcock presented at the AAA conference (https://www.audiology-worldnews.com/profession/2124-do-you-repulse-your-clients), and he approached this topic from the perspective of the social sciences. Due to long-standing negative attitudes and stigma around hearing loss, people tend to avoid hearing care instead of approaching it. In an effort to change these attitudes, Alcock explains that clinicians and providers should consider revising the terminology they use. Instead of talking about the individual having a hearing “loss”, change the terminology from “loss” to “difficulty”. In addition, rather than administering an audiological test where the results are “pass” or “fail”, discuss it with your patient as a function of being able to measure and confirm their hearing difficulties. Acknowledge and validate that their hearing difficulty is affecting their ability to communicate. Use the Count-the-Dot audiograms or an audiogram that has a speech banana. If their hearing loss is high frequency, confirm the fact that they are having difficulties communicating because they can't hear these specific consonant sounds. Then, offer them a treatment option (hearing aids or some sort of amplification), to let them know we can make those sounds now audible to them. Having those deliverables and that value proposition increases those opportunities (Alcock, 2017).

Show Empathy

Another concept encouraged by Alcock is that as hearing care providers, we need to be more empathetic. When patients walk into the audiology clinic, they often have high levels of anxiety. Therefore, to help quell their fears, we can exhibit more understanding and empathy. We know where they’re coming from and we care about their well-being. That empathy then leads to trust, which is an important piece in the patient-provider relationship.

Don't Get Too Technical

When we are discussing technology, we often have a tendency to use the manufacturer's verbiage or nomenclature. For example, if we are describing the features and functions of a hearing device to a patient, we may talk about it using terms such as bandwidth, channels, adaptive directionality, and dynamic range compression. In general, patients don't understand that language. Patients want to know if the technology relieves or lessens some of the issues that they are facing. Instead, inform the patient that this device will improve their ability to hear at a restaurant because this technology that we call directional microphones reduces background noise. Or, let them know that listening effort can be improved when we enable a noise reduction algorithm. Talking to your patients in terms they can understand is a huge value proposition that is likely to improve your adoption rate. (The reader is referred to Amlani et al, 2011).

Be Perceptive to Emotions

In the field of audiology, we need to be aware of the cognitive processing and emotional component related to purchasing hearing amplification. Many people believe that we buy things based on cognition, and that's not true. Our purchasing behavior is based on our emotions. For example, we can look at our experience with purchasing a car or a home. When you are in the market for a new car, if the sales representative becomes pushy or aggressive, many people will lose interest, walk away and look for another dealership. It's the same thing in the hearing care industry. Tapping into people's emotions is critical. We have patients that walk in with high anxiety and we need to be able to temper those emotions, earn their trust and break the ice. You might have a casual conversation before the examination regarding a community event or the local weather. Then, they will buy into you as a person, which then improves their emotional reactions, and can translate into them purchasing products and services from your clinic.

Listen When Counseling

Researchers have looked at the field of audiology to assess the emotional intelligence of hearing care providers. In other words, how well do we listen and how well do we counsel? As it turns out, as a profession, we don't do this very well. Research has shown that in a 30-minute counseling session, the provider is talking for roughly 25 to 27 minutes, and only three minutes is granted to the patient. Clearly, we are not very good at allowing the patient to have speaking time. We continue to interrupt them, we're not actively listening, we may have our minds on the next patient or something else. We overemphasize the technical aspects of device care and we're perceived as not empathetic and trustworthy. We have what is referred to as low emotional intelligence. By improving our emotional intelligence and having a better connection with the patient, we can improve the conversion rate (Ekberg et al, 2014; Grenness, et al, 2014; Grenness, et al, 2015; Knudsen, et, al., 2010; Laplante-Levesque, et al, 2014; Munoz, et al, 2014, and Munoz, et, al, 2015).

Use Social Media

Another method that's useful for promoting your clinic and your services is to develop a social media strategy. If your clinic has a Facebook page, for example, patients can leave reviews and comments on your page and can share their experience with you as their practitioner. Or, you can share posts and comments so that potential patients can get a feel for what you have to offer. Be careful not to post "scare tactics" (e.g., "If you don't get hearing aids, you will get dementia"). Also, another thing I see practices do on social media is to reduce their prices. Those are the wrong ways in which to gain the trust of the community to see you as their local provider. One idea is to implement storytelling by creating a video and posting it to YouTube, for example. There are many examples of these types of videos that you can view as a jumping-off point for making your own.

Bring In the Communication Partner

One thing that can be helpful, especially when working with geriatric patients or patients who have verbal or cognitive difficulties, is to bring in a communication partner. A communication partner who knows the patient well can be an invaluable connection to verbal expression. The ideal partner knows the individual’s personality (including communication style), educational background, health history, and cultural background. The communication partner is able to help share patient information with you, the clinician, as well as to help relay care information from you to the patient. If the partner trusts you as a clinician, they will then impart that sense of trust to the patient, and the likelihood of conversion increases.

Offer Service Packages

Another method for improving the conversion rate of your clinic is to offer service packages. If you itemize, you could have a bronze, gold or universal service package, for example. You would then take the value propositions that you were going to provide, calculate that as a function of your breakeven analysis or hourly rate, and provide those services so that you're able to see more patients on a regular basis, yet not lose income or revenue. This is an important concept for those individuals who are looking at playing in the market when direct-to-consumer or OTC products become available.

Get Preventive

Finally, preventive care is a key area in which the hearing healthcare industry has been lacking. In audiology, we have a tendency to be reactive as opposed to proactive. As an example, let's look at the field of dentistry. If you visit the dentist because of tooth pain, as you leave, they will then schedule you for a cleaning. When you show up to that cleaning, they'll schedule you for another cleaning because most insurance pays for one or two visits annually. However, there is no literature to suggest that having your teeth cleaned reduces the likelihood of cavities. It would be wonderful if we could employ a similar mechanism for preventive audiology. We could measure a baseline for each patient, and continue to monitor the patient's hearing over time. This would be especially helpful for adolescents who use wireless earbuds and headphones all the time. Preventive hearing care is critical to sustaining your value proposition in the market, allowing you to retain patients for a longer period of time, over the lifespan of their continuum in the marketplace.

Summary and Conclusion

I'd like to conclude with a quote from Maya Angelou that I think lends itself well to this concept of competing in the marketplace based on value: "I've learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel." ~Maya Angelou

As you consider your value proposition, in order to remain competitive and successful in the "new" hearing healthcare arena, you must rely on service provision. Provide services that meet the needs of your patients, while maintaining a professional standard of care. Avoid cannibalizing your efforts (i.e., offering free hearing tests). By branding your services, you'll be able to meet the needs of the patients in your community, and people will identify you as the individual that provides the best hearing care in that environment. Always remember that you control your own fate.

References

Aaron MJ. (1987) An Economic Study of the United States Hearing Aid Industry: A Demand- and Supply-Side Examination. Unpublished doctoral dissertation. University of Illinois, Chicago, Illinois.

Abel D, Coverstone J. (2019, May 24). The cost of free. https://hearinghealthmatters.org/hearingeconomics/2019/audiology-cost-of-free/

Amlani AM. (2009). Increasing total revenue in an inelastic hearing aid market. ENT & Audiol News, 18(5), 82-85.

Amlani AM. (2010). Will federal subsidies increase the US hearing aid market penetration rate? Audio Today, 22(2), 40-46.

Amlani AM, Taylor B, Weinberg T. (2011). Increasing hearing aid adoption rates through value-based advertising and price unbundling. Hearing Review, 18(13), 10, 12, 16-17.

Amlani AM. (2014, October 7). A Siemens Divestment Could Renew Market Competition. Hearing Economics. https://hearinghealthmatters.org/hearingeconomics/2014/siemens-divestment-renew-market-competition/

Amlani AM. (2016). Application of the Consumer Decision-Making Model to hearing aid adoption in first-time users. Sem Hear 37(2): 103-119.

Amlani AM.(2017, August 22). Relationship between OTC Price and Behavioral Performance: A Guiding Light. https://hearinghealthmatters.org/hearingeconomics/2017/amyn-2/

Amlani AM. (in press). Influence of provider interaction on patient’s need recognition towards audiological services and technology. J Am Acad Audiol.

Amlani AM. (in press). Pricing Strategies in Audiology Practice. In Taylor B (Ed.), Audiology Practice Management, Third Edition. Thieme Medical Publishers: New York.

Amlani AM, De Silva DG. (2005) Effects of business cycles and FDA intervention on the hearing aid industry. Am J Audiol 14(1):71–79.

Amlani AM,Pumford J, Gessling E. (2016). Improving patient satisfaction and loyalty through real-ear measurements. Hearing Rev. 23(12), 12-16, 18, 20-21.

Blackwell RD, Miniard PW, Engel JF. (2001). Consumer Behavior. Fort Worth, TX: Harcourt Brace College.

Callaway SL, Punch JL. (2008). An alectroacoustic analysis of over-the-counter hearing aids. Am J Audiol, 17(1): 14-24.

Coverstone J. (2019). The need for standards in audiology. Hear Rev, 26(3): 24-29.

Ekberg K, Grenness C, Hickson L. (2014). Addressing patients’ psychosocial concerns regarding hearing aids within audiology appointment for older adults. Am J Audiol 23(3):337-350.

Ferguson MA, Kitterick PT, Chong LY, Edmonson-Jones M, Barker F, Hoare DJ. (2017, September 25). Hearing aids for mild to moderate hearing loss. Cochrane Systematic Review. Retrieved from https://www.cochranelibrary.com/cdsr/doi/10.1002/14651858.CD012023.pub2/full

Grenness C, Hickson L, Laplante-Lévesque A, Davidson B. (2014). Patient-centered audiological rehabilitation: Perspectives of older adults who own hearing aids.Int J Audiol, 53(Suppl 1):S68-S75.

Grenness C, Hickson L, Laplante-Lévesque A, Meyer C, Davidson B. (2015). The nature of communication throughout diagnosis and management planning in initial audiologic rehabilitation consultations. J Am Acad Audiol26(1):36-50.

Hosford-Dunn H, Amlani AM. (2016, July 19). Price Functions in the US Wholesale Hearing Aid Market – Part 3. Co-Edited Blog, https://hearinghealthmatters.org/hearingeconomics/2016/price-political-football/

Hougaard S, Ruf S, Egger C, Abrams H. (2016). Hearing aids improve hearing-and A LOT more. Hear Rev, 23(6): 14.

Knudsen LV, Oberg M, Nielsen C, Naylor G, Kramer SE. (2010). Factors influencing help seeking, hearing aid uptake, hearing aid use and satisfaction with hearing aids: A review of the literature. Trends Amplif, 14(3): 127-154.

Laplante-Lévesque A, Hickson L, Grenness C. (2014). An Australian survey of audiologists’ preferences for patient-centeredness. Int J Aud, 53(Suppl 1): S76-S82.

Meyer C, Hickson L. (2012). What factors influence help-seeking for hearing impairment and hearing aid adoption in older adults. Int J Audiol, 51(2): 66-74.

Munoz K, Olsen WA, Twohig MP, Preston E, Blaiser K, White KR. (2015). Pediatric hearing aid use: Parent-reported challenges. Ear Hear, 36(2): 279-287.

Munoz K, Preston E, Hickson S. (2014). Pediatric hearing aid use: How can audiologists support parents to increase consistency? J Am Acad Audiol, 25(4): 380-387.

Reed NS, Betz J, Kendig N, Korczak M, Lin FR. (2017). Personal sound amplification products vs a conventional hearing aid for speech understanding in noise. JAMA 318(1): 89-90.

Rosenstock IM. (1966). Why people use health services. Milbank Q 44(3):94–127.

Windmill IM, Freeman BA. (2013). Demand for audiology services: 30-yr projections and impact on academic programs. J Am Acad Audiol, 24(5): 407-416.

World Health Organization (2018). Addressing the rising prevalence of hearing loss. Geneva, Switzerland. Retrieved from https://apps.who.int/iris/bitstream/handle/10665/260336/9789241550260-eng.pdf;jsessionid=F27662DD6A24177F5547B0C5D1794CB8?sequence=1

Citation

Amlani, A. (2019). Signia expert series: competing in today's disruptive audiological environment. AudiologyOnline, Article 25449. Retrieved from https://www.audiologyonline.com