Editor’s Note: This text course is an edited transcript of a live webinar. Download supplemental course materials.

Donna Sorkin: Before we get into our topic today, I wanted to briefly give you some background on American Cochlear Implant (ACI) Alliance. We are a non-profit organization, and our membership is comprised of cochlear implant (CI) clinicians, educators, consumers, parents and advocates for access. Our mission is to advance access to the gift of hearing provided by cochlear implantation through research, advocacy and awareness. We want to address factors contributing to the underutilization of CIs. We know that of the people who could benefit from a CI in the United States, only 6% have one. Pediatric use is higher than adult use; however, it is still almost half of use rates in Western Europe.

How did ACI become involved with the Affordable Care Act (ACA)? ACI met with many other professional organizations about initiatives we should be taking on. We met with organizations for audiologists, speech-language pathologists, physicians and teachers of the deaf, and they hoped we were working on ACA coverage, because they were not doing that yet. We looked at the law as an opportunity for expanding access without taking a position about whether it is a good law or a bad law. It is the law, and we want to ensure coverage to the extent that we can. We know that most public and private insurance plans cover CIs, but there are still candidates without insurance and a few remaining outlier plans that do not offer coverage, so we wanted to try to get it right with the ACA.

We hope to ensure that there is appropriate coverage under the new marketplace plans. We want to be able to advise patients who want to purchase insurance, and we also want to impact state policies. Specifically, we want “gold-standard” language in each of the states’ essential health benefit (EHB) plans. To do this, we will make contact with the appropriate state officials and have them serve as a point-of-contact to the Alliance and to others. They will help us monitor what is happening as this new law rolls out and report back to us so that we can affect changes at the national level.

At this time, I would like to turn the presentation over to Theresa, to provide an overview of the Affordable Care Act.

Overview of the Affordable Care Act

Theresa Morgan: Thank you, Donna. I want to give a brief overview of the ACA. Most of you are well aware that the law represents a massive overhaul of the United States’ health insurance market system. It is the largest law to regulate insurance products at the federal level, which traditionally was left to the states to regulate. The federal and insurance market reforms are being implemented using an existing state system. The Department of Health and Human Services (HHS) made a determination during the regulatory process after the law was passed to go ahead with what the state was already doing and implement the new requirements. It is quite difficult to track state-by-state reform, but we are doing our best. Of course, the state law still stands, but now the ACA overlays that, and there are federal programs running simultaneously with state programs. It can get complicated to track and monitor what is happening.

The ACA has two monumental tasks. One is expanding insurance coverage so that we can get as close to universal coverage as possible in the United States. The other is to reform healthcare delivery models in the United States. Today we are focusing on the insurance coverage expansion portions of this. Our state champions are talking about benefits coverage and market reforms, not about delivery reform. The intent of the ACA is to extend coverage, and there are multiple ways that the law intends to do this.

One is to require individuals to purchase insurance, which is the individual mandate. The other is to expand Medicaid, which is on a state-by-state basis. The Federal government is stepping in and offering subsidies to those within a certain income level who might not be able to afford insurance premiums. Starting this year, most insurance plans cannot deny people access to coverage due to preexisting conditions. That is something that the insurance companies must shoulder. They also wanted to place incentives and expand the employer-sponsored insurance system; with that comes a penalty to employers who drop insurance coverage for their employees.

On October 1, 2013, both the federal exchange and state exchanges were scheduled to open. They did open with many hurdles and technical difficulties, but there were existing reforms in place, including the ban on preexisting conditions and denial for children that went into effect in 2010. Young adults could already stay on their parents’ insurance plans until the age of 26, and there were no lifetime monetary caps on what were considered EHBs. But now in 2014, there are significant critical-coverage cost requirements that go into effect. One that I have already mentioned is that most plans can no longer deny coverage based on condition, disability, health, status or age. That is important particularly for individuals who could not get health insurance because they already have a condition in the past. Issuers are prohibited from designing discriminatory benefit packages or setting price based on health status. There are no annual coverage caps allowed under EHBs. For example, if there is a monetary cap on a device that existed prior to 2014, new plans must eliminate those kind of caps. Additionally, mental health parity applies to all health plans moving forward.

Many of you have heard in the news that there have been significant problems with enrollments. Simultaneously, there have been individual plan cancellations. If existing plans were not grandfathered into the existing system, they were required to shut down. So thousands of individuals across the country received notices of plan cancellations and that they would have purchase new insurance, sometimes at a higher cost, as of January 1, 2014. However, some plans were cancelled but the technical difficulties with the exchanges meant that people could not enroll into the new system.

Cochlear Implantation as an Essential Health Benefit and Benchmark Plan Process

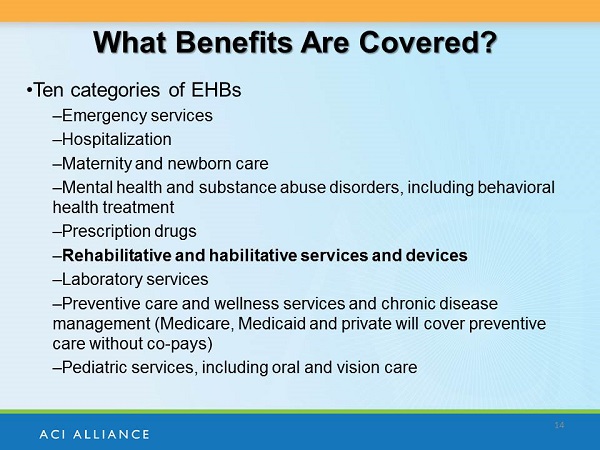

Under the new law, 10 categories of benefits must be covered in any minimum benefits package offered on the exchange or outside of the exchange if it is a new plan (Figure 1). One of the categories is rehabilitative services and devices. This is the category where CIs would seem to fit most naturally. The law does not go into any specific detail other than the 10 categories about benefits coverage; the law does not specify what must be covered under rehabilitative services and devices. The federal regulations did not specify the individual services which must be covered under the benefit categories and chose to defer to the states to further define, regulate, legislate and grandfather existing plan coverage. This was the way to create state-by-state EHB package, which become the minimum benefits package in your state.

Figure 1. Ten categories covered under the EHBs.

The benchmark plan system acts as a template for issuers in their states. Each state has selected or defaulted to an EHB benchmark plan. It has been revised to meet the new standards and is now being used as template for different plans in each state. Once the plan has been certified to meet the new requirements, it is a qualified health plan in that State. Although monetary annual and lifetime caps are prohibited, plans can substitute benefits within the category, place visit limits on the benefits, and use other “utilization management techniques.” Let's say Blue Cross Blue Shield is operating in Maryland; they can look at the benchmark plan that Maryland has selected, but they do not have to copy it exactly. They can adjust what is offered in their plan based on what is offered on the Maryland exchange. Since most benchmark plans cover CI, we expect that most 2014 plans will also cover CI. That is the caveat, of course; substitution is allowed in many states. I am going to turn it back over to Donna to talk about what that means to CI.

Donna Sorkin: The underlying premise of the ACA is that plans offered must mimic what is typical of commercial insurance plan coverage. Presently, cochlear implantation is covered by over 90% of commercial plans and by Medicaid, primarily for children, although sometimes not for adults. It is also covered by Medicare, so we expect that these benchmark plans would cover based on the law's intent for typical coverage. In fact, we have found no stated exclusions. A few states do mention CI by name in their central health benefit plans as a covered service, but most make no mention at all. In all of the benchmark plans that we have examined, we found that there was coverage for cochlear implantation. There is some ongoing confusion in one state, but we believe that it does cover.

We are looking at coverage, but we are also trying to emphasize the continuum of care and ensure that CIs are appropriately covered. We want to ensure that the coverage language is clear and that new carriers on the marketplaces also offer coverage, because, as Theresa mentioned, they can make substitutions. The entire continuum of care includes not only the surgery, but the pre-operative audiology and medical assessments, consideration of bilateral implants, and all the aftercare including rehabilitation and counseling to address continual maintenance of the device.

A clean document of the entire continuum graphic is available on the ACI web site. We developed this to provide to the state champions so they can use it to explain to insurance commissions that we need to cover this entire continuum of care. It explains challenges that we have seen in the past and gives us things to watch for under the new agencies to ensure that replacement parts and processor upgrades are covered. We have seen large copays, with typical upgrades up to every four or five years, unless the device is broken.

We have seen limitations on the number of rehabilitation sessions. Adults and children are typically covered, but this limitation can be a problem and can be appealed. These kind of issues are not necessarily fixed by the ACA, so we will be keeping an eye on these substitutions that can go forward on the state benchmark plans. Our state leaders are monitoring their marketplace plan offerings for these kinds of issues.

Health Care Marketplace: State Oversight

Theresa Morgan: The health insurance marketplace is intended to operate as an online market to purchase and sell regulated, qualified health plans, or QHPs. Seventeen states have established their own exchanges so far. The law gives states the option to run their own exchange, partner with HHS, or leave most or all of it to the Federal government and operate in the exchanges utilizing the federal web site. Although 17 states have their own exchanges, I think HHS was hoping that more states would get on board and want to take over the authority for themselves. This leaves 7 states to partner with HHS and 27 states to operate in the federal exchanges, which is a large number of states that are using the federal exchange to help millions of people enroll in insurance, obtain clearance to qualify for subsidies, or to qualify for Medicaid or determine what plan might best fit the needs for the individual applicant.

Transparency of coverage is also a challenge in the federal marketplace. There is one web site but 27 different essential health benefits plans. That is 27 different benchmark plans, and then there could be hundreds of individual plans that are mimicking those within each state; who's in charge of the oversight? Who can look at those plans, certify them, and ensure to the best of our knowledge that they are reasonably covering a substantial amount of the same benefits that are covered in the benchmark? These are some of the challenges that the federal marketplace will continue to have as they try to help 27 states establish healthcare reform in their areas.

The state does have a substantial oversight role, which was a federal decision. Most states have regulatory infrastructure that already certifies healthcare plans. The insurance commissioner's office or Department of Insurance in your state already does much of the oversight work under existing state law. HHS had the idea from the beginning to take that state structure and expand it so that the state can still maintain the oversight role, even under the ACA requirements. State law still applies, and the Department of Insurance in those states still has the authority to oversee and enforce ACA and existing state law.

Many are learning the ins and outs of the law with input from stakeholders. When our champions reach out to the Department of Insurance, even in states utilizing the federal marketplace, they welcome the input from stakeholders. They need the information and are likely lacking resources to adequately manage the oversight role that they have. Everything is very new, and they need champion eyes and ears on this issue so that they can get the information they need to help enforce the law. It is challenging to determine who the go-to person is in the state, especially if the state politically or practically has not embraced the ACA. We have found that it is possible to identify office and individuals working on implementation and to establish relationships in the states through email and phone outreach. The Kaiser Family Foundation web site (https://kff.org) is a good resource to see national tracking of where different states are both on the Medicaid expansion and on health insurance exchanges.

State Champion Program

Donna Sorkin: I want to give you background on the state champion program and then provide case studies to illustrate what our champions are working on. Allied organizations in the field of hearing loss indicated that this was a key priority, yet none of them were actively working on coverage issues for implantation. We are a small organization with few staff members; we very much rely on volunteers. Furthermore, our state-based clinicians are the ones that will be most effective at monitoring and affecting change, so we initiated the state program to support individuals in each state to address CI coverage.

The first thing we wanted them to do is make contact with state insurance offices and begin to identify individuals with whom we can work. We wanted them to monitor the marketplace rollout and what is being covered and then report back. In some cases, we have had people make their way through the signâ 'up process. One physician helped a family, not even at their clinic but within the state, negotiate the exchange. That is another wonderful resource and point-of-contact in the state for clinicians to be able to help their patients.

As of January 2014, there are 25 states with one or more ACI Alliance state champions who have taken on the challenge of working on coverage issues in their states. We mentioned the fact they are contacting state insurance offices to confirm coverage and establish a point of contact. Many of them have requested what we are calling the gold-standard language to ensure clarity of coverage. There is gold-standard language that we would like to see show up in essential health benefit plans for each state, such as outpatient and inpatient surgery (as deemed appropriate), devices inclusive of bilateral CIs, early intervention, needed follow-up, clinical services including audiology rehabilitation and durable medical equipment (DME), which is the maintenance we talked about in the continuum of care statement.

State Champion Examples

State champions are serving as a resource for clinicians and professionals within each state. To share what some of the fantastic state champions are doing, I will begin with Florida. Our state champion there is Ivette Cejas, Ph.D., who is a psychologist and Director of the Baron G Kids Hear Now CI Family Resource Center, which is associated with the CI clinic at University of Miami. Dr. Cejas started by contacting state officials, so she now has a number of contacts in the insurance office and throughout state government for people that are touching the rollout of the program. She very quickly confirmed CI coverage in the benchmark plan and asked for them to use the gold-standard language that I shared with you. They indicated that they could not do that in 2013 but have now added that to their 2014 legislative package in the Office of Insurance Advocates.

We feel solidified language will help to ensure that we have best possible coverage in the state. I asked a number of state champions to provide you with advice on what they found in their work. Dr. Cejas’ advice was to start by making one phone call. This seems daunting and intimidating because we have not done it before, but start by making one phone. Call and talk to that person and figure out who else to you can talk to. Repeat the process over and over and talk about the law and the rollout. In general, these offices have been very open to listening to our cause and very positive about working on coverage. I think there is a benefit to the fact that we are using state-based clinicians who are speaking about intervention with which they are directly involved, rather than someone from a manufacturer lobbying in Washington.

The next champion is Margaret Winter, M.S., from California. She is an audiologist and the Coordinator of Clinical Services at House Research Institute. Margaret works primarily with children and has been in the area of CIs for a long time. She has never participated in advocacy before, other than staying on top of insurance plans for her patients. She started by contacting the Department of Managed Care, who eventually called her back two weeks later. She confirmed coverage herself by obtaining and reading the Evidence of Coverage policy, and then said to the state official she spoke with, “I want you to confirm that the coverage is there for CIs.” At this time, an article had been published in California erroneously reporting that cochlear implantation was not covered in California, so everyone was in a frenzy. Margaret got an Evidence of Coverage policy and confirmed it with the state, and that was important early on for us to have that confirmation. It was a lesson that you cannot believe everything you read on the Internet, no matter how credible the author. The insurance document was confusing, and the author was not familiar with cochlear implantation. They did not know the difference between CIs and other auditory devices.

Her advice was to call private insurance brokers for participating insurers. She noted that they can help with signâ 'up and with understanding the coverage. Margaret found that they were quite open about talking to her and were very helpful.

My last example is from Dr. Sarah Mowry, M.D., in Georgia. She is an associate professor in the Department of Otolaryngology at Georgia Regents University. She found no information on the Internet about CIs and could obtain no information from Blue Cross Blue Shield because she was not a subscriber. They were not very forthcoming with information, so she then worked directly with the Insurance Commissioner to confirm coverage. There was no explicit language concerning CIs, so she is now working with the Insurance Legal Council on the lack of transparency.

She described herself as a fish out of water because she was a surgeon and not an insurance advocate. She wanted to do it, however, to ensure her patients had the coverage they needed. Her advice was to be persistent. She made multiple phone calls and sent multiple emails and finally was able to get a meeting with the top insurance official in the state. She also noted that she liked the web site www.naic.org/index_health_reform_section.htm and is recommending that to us as well.

Medicaid Expansion

Theresa Morgan: Medicaid expansion is part of the ACA. The ACA created a new mandatory eligibility group, which is all adults over the age of 19 who meet low-income threshold requirements. States in the past have had the option of expanding Medicaid to this population, but now it was a population that was listed as a mandatory eligibility group. There was a challenge on that aspect that made it to the Supreme Court. The Supreme Court ruled that the Medicaid expansion could not be mandatory under the ACA. The state could, upon choice, expand the eligibility category in the state and receive new federal funding, or decline to expand to the new eligibility category in the state and still receive the funding for the old eligibility categories for the traditional Medicaid-eligible participants in the state.

This threw the Medicaid expansion on its head, to a certain extent. Many of the predictions for how many people would get insurance under the ACA were based upon 50 states expanding Medicaid. As of now, only 26 states have decided to implement the expansion for the new eligibility group in 2014. There is no deadline for expansion. Any state that did not expand this year can expand in the future. However, they have to fully expand to the new eligibility group, go up to 133% of the federal poverty level for all adults meeting the income requirement or below, and they cannot go up to 100% or 110% if they want the new federal matching dollars. It is anticipated that a number of states may expand in 2014, and potentially all states may expand in the future, but it is unclear what will happen in the next few years, so we had to revise our expectations on how many people will get health insurance through Medicaid in various states.

As of this year, all existing Medicaid benchmark and benchmark-equivalent plans must cover EHBs within the ACA. States have been able to create Medicaid benchmark plans under existing Medicaid authority. They can tailor to specific plans within the state and offer different benefits under those plans than they would under the state Medicaid plan. But all of those plans, existing or new, have to cover EHBs. That is not a requirement for the state Medicaid plan. It is only a requirement for the benchmark and benchmark-equivalent plans, which are now known under the ACA as alternative benefit plans, or ABPs.

Some are using the Medicaid expansion opportunity to get more creative and amend their entire state plan. Some are filing for section 1115 waivers, for example, and doing experimental or demonstration programs. New Mexico has approved demonstration to put their Medicaid expansion into a Medicaid Managed Care program, while creating a separate benefit package for the newly expanded plan under the Medicaid Managed Care program. It gets quite complicated, but it is good to note that these new plans have to cover EHBs, which, by and large, may represent a series that were optional for adults under traditional Medicaid that now have become mandatory in one of these new benefit packages.

Medicaid Coverage for CI

Currently, Medicaid state plans cover CI as an optional service for adults. Children are covered in all 50 states because of Medicaid requirements specifically geared toward children. Medicaid ABPs must cover essential health benefits. If a CI is considered an EHB, the service becomes mandatory as an EHB for adults in that the state. This means that there is an opportunity through this new requirement under the ACA to improve CI coverage for adults under Medicaid.

Donna Sorkin: We mentioned that children are covered under Medicaid in all 50 states. The legislation requiring that is called EPSDT, which stands for early periodic screening diagnostic and treatment services. This says that states must cover medical treatments for children that, left untreated, would otherwise impede development. CIs, as a treatment for deafness, is one of those qualifying treatments in all 50 states.

Some states have very poor reimbursement for the surgery. This is a procedure that reimburses about $30,000 under Medicare. However, in the state of Georgia, for example, the hospital only receives $5,000 reimbursement under Medicaid for a child. Half of the surgeries performed in some southern states are on children under Medicaid, and it becomes a financial drain for the hospital for this category of children. We have seen programs close their pediatric program but left the adult program open because in those states adults were not covered by Medicaid.

CI is an optional service, which means states can decide whether they want to cover adults. Children are covered in all 50 states because of Medicaid requirements. Adult Medicaid coverage in those states with poor reimbursement could become an access issue. Furthermore, adding adult Medicaid coverage could further exacerbate reimbursement issues. We love the fact that it could expand coverage for adults, but there are changes in the way the hospitals would have to be reimbursed for the intervention.

Summary

In summary, insurance is available from the new federal healthcare marketplace, and it appears that they will be covering CIs in the state benchmark plans. That is not currently the case, so we will continue to monitor progress in these states. We have people in place to continue to monitor and address these concerns. The signâ 'up process has been confusing and rather inept, and patients may need help in negotiating the enrollment process. The ACI Alliance state champions are working with the state officials to monitor coverage and provide guidance to others. If any of you are involved in cochlear implantation and wish to get involved in the program in your states, please e-mail me at dsorkin@acIalliance.org to let me know you are interested; we still have 25 states uncovered. We do provide training, and this is a great opportunity to advance the cause and become expert in an area where we did not have expertise in the past.

Figure 2 is a list of resources that we think will be helpful to you. You may want to familiarize yourself with Healthcare.gov. We like The Daily Briefing on Medicaid and the ACA. The Center for Consumer Information and Insurance Oversight as a part of the Centers for Medicare & Medicaid Services (CMS) has a care chart, which is in the FAQ section of our web site. We will also be using Twitter (@acialliance) to disseminate information on this topic.

Figure 2. Web resources.

Question & Answer

What states do not cover cochlear implantation for children?

All states under Medicaid cover implantation for children.

Which states have high co-pays?

It is very dependent upon the individual commercial plan rather than the state. There are different standardized tiers of coverage in every state. The cost and subsequent rate depends on the tier. The higher the tier, the more expensive the plan, but likely those have a lower premium. If you wanted to get something similar to a catastrophic plan with low premiums and a high deductible and other cost-sharing things like coâ 'pays, those are normally within the lower tiers. As you go up the tiers, you will have higher premiums but maybe no deductible and very small copays. The question is specific to copays, but there are patrols on how high the premiums can get. That is a new ACA requirement, but they do vary by state.

What is DME?

DME stands for durable medical equipment. You will often see this term in an insurance plan, so it is a good one to know. It refers to the pieces of the sound processor and cords on the external side. It can also refer to batteries, particularly for children on Medicaid, and it refers to the maintenance and replacement of the sound processor, as well. All the companies periodically upgrade and replace their sound processers, so be sure that your patients are participating in the replacement opportunities. Typically, there is a timeframe in which insurance companies will provide an individual an upgraded processor. Sometimes you can convince the insurer to provide that upgrade out of cycle, especially if a child needs it to have better access to sound in an educational environment, or for adults who need it for employment opportunities or advancement. You can appeal or make a case for replacement outside of that specified time requirement.

What is the enrollment deadline for insurance coverage?

There is a rolling deadline for insurance coverage. Open enrollment ends March 30, 2014. You would need a qualifying life event to have guaranteed issue after that date, but if you want coverage to start on the first of the next month, you need to enroll by the 15th of the current month.

Donna Sorkin: I would also encourage everyone who is involved in cochlear implantation to be a part of the ACI Alliance. Please join us. We need you to advance our mission. We are a small, dedicated core of people who care very much about this intervention. It is people of the field that are going to drive change. Thanks again for attending this webinar today.

Cite this content as:

Sorkin, D.L., & Morgan, T. (2014, March). Expanding access to cochlear implantation under the Affordable Care Act, presented in partnership with the American Cochlear Implant Alliance. AudiologyOnline, Article 12471. Retrieved from: https://www.audiologyonline.com