Learning Objectives

After this course, you will be able to:

- List the new ICD 10 coding changes effective October 1, 2016.

- Describe health care reform, its impact on audiology and on quality reporting.

- Explain medical necessity and its role in audiology.

Dr. Kim Cavitt: As you know, coding and reimbursement are moving targets as the information is constantly changing. Refer to the audiology associations that you are a member of for the most current information. Please note that the links I have in this presentation were current at the time of the presentation, but are subject to change.

PQRS

PQRS is the Physician Quality Reporting System. It was scheduled for retirement on December 31st, 2016. That means that beginning January 1, 2017, audiologists have no mandatory reporting requirements for PQRS. We will not have any penalties in 2019 because we are not a required reporter in 2017.

Audiologists should have continued to positively report on at least 50% of eligible traditional Medicare patients through December 31, 2016 for all six measures they are required to report on (based on the procedure provided), in order to avoid the 2% penalty in 2018.

The replacement system is the Merit-Based Incentive Payment System, or MIPS. It does not include audiologists as a qualifying provider until at least January 1st, 2019. MIPS is going to be a much bigger system with many more requirements, both in clinical improvement activities and in the types and numbers of measures we will need to report on. We may have a registry requirement and there may be something about electronic health records, along with other changes with MIPS; we're not sure at this point and trying to get answers. Here is the link.

What Does this Mean for Audiologists?

Today, there are only voluntary reporting requirements. If you want to still voluntarily report on claims in 2017, you can do so, either via claims, a registry, or via electronic health records (EHR). There may be no means of actually looking at the data you're voluntarily reporting; we are waiting for an answer on this. They have not been clear with the audiology community on whether or not anything that you voluntarily report will be something you can access in a QualityNet Verification Report.

Quality reporting and outcome-driven payment will still be the norm throughout healthcare. MACRA (Medicare Access and CHIP Reauthorization Act), which brought us this MIPS program, was bi-partisan legislation in 2015. Paying for performance precedes Affordable Care. Repeal of Affordable Care, should that happen, will likely have little impact on quality reporting or pay for performance. The Bush administration, in bi-partisan legislation, introduced PQRS and paying for performance. The future of payment is about payment for performance and outcomes, and not getting paid just because you performed a service.

Audiology’s role in MIPS is still very ill defined at this point. We should know more within the next year. Today, all the former and current PQRS measures are part of MIPS; all six of the measures that we concurrently report on are being pushed forward now in MIPS. We don't know if that will still be the case by the time audiology is a required reporter. As I mentioned, electronic medical records may be required – there is a hint at that in the final rule. We're trying to see what that really means for audiology, and if it may depend on the size of your practice. Registry reporting, rather than claims reporting, may be required. A registry is something that's maintained by an association or company where you actually report in a separate system rather than report on your claim to Medicare. ASHA is developing a registry that includes the audiology measures, but what that means for its use across professions is not clear since it’s still in beta. There will likely be a registry available in the profession within the next year.

How will you find out about these forthcoming changes? You will find out through the national associations of which you're a member, and I will always provide an update for AudiologyOnline. If you are not a member of a national association, you will not receive these important updates that will be shared across the associations to members.

Keep in mind that the measures related to falls risk, medications, smoking, and depression, are really about quality patient care, not just payment. I cannot more strongly recommend that we continue to ask these questions that have been required of us as part of reporting. These questions are important in showing our value in the healthcare system, and they are valuable to the patients we serve. If we want to differentiate audiology care from other providers and from increasing competition like online providers, then we need to look at the whole patient. We need to look beyond the audiogram and the hearing aid. The audiogram is a very archaic means of assessing communication. Whether or not a patient is at risk for falls may have a significant impact on their overall healthcare. A patient’s medications, and if they smoke and/or have depression, may also have an effect on the auditory and vestibular systems, and the patient's ability to participate in their care. We should continue to ask those questions that were required of PQRS, as the answers may affect our plan of care.

We also need to be prepared that we may see some audiology included in some new measures with MIPS, such as blood pressure, pain, and body mass index. They’re trying to spread these types of measures across every provider, and to date we have been able to resist that from happening. We're not sure that we'll be able to resist them in the MIPS system.

CPT and HCPCS 2017

There are no new audiology-specific CPT (current procedural terminology), or HCPCS (healthcare payment system codes), for 2017. The 92- codes, the V codes, and the L codes remain unchanged for audiology in 2017.

ICD-10

We do see changes in ICD-10, which went into effect on October 1, 2016. ICD-10 changes will always occur on October 1st, and they will be what I call a “light switch” change: on September 30th, you're doing one thing, and on October 1st, you're doing another.

In your handout, I've listed the ICD-10 codes that have the biggest impact on audiology. There are several new codes, but the ones with the biggest impact affect coding for different type of hearing loss in different ears. It's important to know that “restricted” means abnormal (i.e., there is a hearing loss in that ear), and “unrestricted” means normal. Also, when a code ends in a 1, that means right ear; when a code ends in a 2, that means left ear, and when a code ends in a 3, that means binaural. If you have different types of hearing loss in different ears, use two codes to reflect the different types of hearing losses in the two different ears.

Let’s look at some of the new codes. When there is a conductive hearing loss in one ear, and a sensorineural or mixed hearing loss in the other ear, use either of these codes:

H90.A11: Conductive hearing loss, unilateral, right ear, with restricted hearing loss on the contralateral side

H90.A12: Conductive hearing loss, unilateral, left ear, with restricted hearing loss on the contralateral side

When there is a sensorineural hearing loss in one ear, either a mixed or conductive in the other ear, use:

H90.A21: Sensorineural hearing loss, unilateral, right ear, with restricted hearing loss on the contralateral side

H90.A22: Sensorineural hearing loss, unilateral, left ear, with restricted hearing loss on the contralateral side

When there is a mixed hearing loss in one ear, and either a sensorineural or conductive in the other ear, use:

H90.A31: Mixed conductive and sensorineural hearing loss, unilateral, right ear, with restricted hearing loss on the contralateral side

H90.A32: Mixed conductive and sensorineural hearing loss, unilateral, left ear, with restricted hearing loss on the contralateral side

Again, you will need two codes to reflect the two different types of hearing losses in two different ears. You can go back to the other system and the other codes that we had before to reflect if they have normal hearing in one ear and a conductive or mixed in the other.

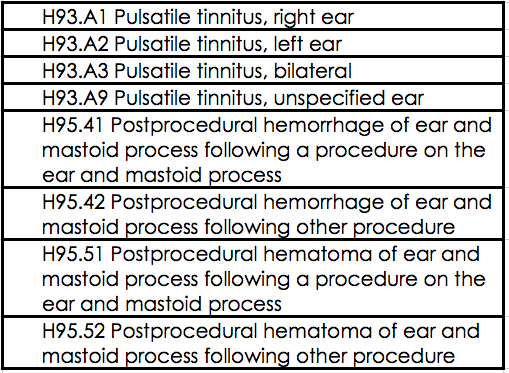

There are some other new codes to consider listed in Table 1. Again, all these codes are listed in your handout. We have pulsatile tinnitus, with codes for right ear, left ear, or bilateral. H93.A9 means that it is an unspecified ear; that means the patient can't perceive if it is in one ear versus the other. I recommend trying to avoid use of unspecified or non-specific codes as much as possible.

Table 1. New codes.

In Table 1, you will also see codes related to postprocedural hemorrhage of the ear or the mastoid following a procedure in the ear or the mastoid.

ICD-10: Important Things to Know

Here are some things that we've learned about ICD-10 now that we have been using it for over a year.

The Medicare grace period for using unspecified codes expired on October 1, 2016. You need to use the most specific code possible, and to avoid using unspecified codes. If you're not sure of the specificity, then you should contact the patient's attending or ordering physician, and have them give you some information about what drove the order of the audiogram. Remember, all hearing tests in the Medicare system require an order. You can contact the ordering/referring physician or primary care physician for guidance on specific diagnoses for medical necessity and then document that in your own medical record. Sometimes you may need to do this only once to find out what underlying comorbidities or specific conditions the patient has that were driving the need for the audiogram.

Avoid the use of a Z code as the primary diagnosis. This can drive a denial. For example, Z01.10 is hearing and/or vestibular evaluation without abnormal findings. That means they had normal results. You want to use that as a last-ditch code, and try to find the reason for the test, or the comorbidity.

Do not use rule-out diagnoses once you know the diagnosis does not exist. For example, do not diagnose a hearing loss when you have found normal hearing, just to get coverage. This is where Affordable Care comes into the equation. One of the benefits of Affordable Care was the lack of being penalized for pre-existing conditions. No one can guarantee that that will maintain itself in the replacement system. Therefore, it is very important that you do not give people a diagnosis in their records (and billing records are patient records) for a condition that they do not have per your test results, just to get payment. Payment is an agreement between the patient and the insurance company. You do not code for coverage. You code to represent what the patient has, what you measure, and what you see. You do not code for coverage, and this is something that you should explain to your patients. Refer to this link for more information.

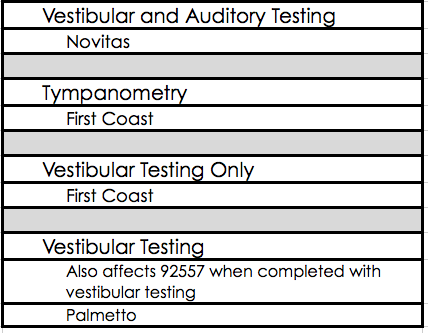

Be aware of local coverage determinations for Medicare contractors. These policies determine what diagnoses are required for payment for specific codes. They oftentimes can also be applied to Medicare Part C or Medicare Advantage plans. Table 2 shows a list of the current local coverage determinations that apply to audiology, along with their associated contractors.

Table 2. Local coverage determinations that apply to audiology.

If Novitas if your payer related to vestibular and auditory testing, there is a local coverage determination that is pretty stringent. There's one related to tympanometry and vestibular testing for First Coast in Florida. There is one related to vestibular testing, which also can have an impact on a hearing test done the same day as vestibular testing, through Palmetto. If you aren't aware of these local coverage determinations, just do a Google search for your contractor and Medicare Part B, and you will see payment policies, or coverage determinations, on their websites. to be able to link to them. Again, you must be aware of these determinations because it is very driven by that diagnosis that you select.

ICD-10 FAQ

Here are some other things that people ask me about frequently in regard to ICD-10.

Coding asymmetric hearing loss. Prior to 2007, there was no ICD-9 code for asymmetric hearing loss. We need to think back to how we coded back then. Now, you will simply code the losses themselves and not worry about the fact that they are asymmetric. For example, if a patient has a bilateral sensorineural hearing loss, and the hearing loss is asymmetric, you will just use code H90.3 for bilateral sensorineural hearing loss.

Coding a routine hearing test. It's very important to know that there is no CPT or HCPCS code for routine hearing tests. I recommend that before you use these codes, you explore whether the payer recognizes the code S0618, which is a hearing test to determine a patient's needs for amplification or treatment. Medicare does not recognize that code. Remember, Medicare never pays for routine tests. They only pay for things that are medically necessary to diagnose or treat a medical or surgical condition. A routine hearing test for a patient who is Medicare-primary is the financial responsibility of the patient. When a patient with a private insurance comes in and says they have coverage for routine hearing tests, you want to look and see how they recognize S0618. The best action is the diagnosis code action of the Z01.10. Again, please remember that sometimes it is the patient's responsibility to pay for an item or service. All of us are consumers of healthcare, and there are financial responsibilities to pay for things such as co-payments, deductibles, co-insurance, and non-covered services. I pay for non-covered services all the time such as to dentists or optometrists, for example. Sometimes, in audiology as well, the patient is responsible for the cost of the procedure. Audiologists can only code what is reported, what they document, what they measure, and what they see. Audiologists cannot code for coverage.

Coverage v. Reimbursement

A frequent issue I see today is a lack of understanding of the difference between coverage and reimbursement. Coverage is when a third party pays all, or a portion of, the cost of an item or service. A lack of coverage does not mean a lack of reimbursement. Reimbursement is when you, the provider, receive payment for the cost of the item or service you provided. We need to care more about reimbursement, and less about coverage. If we are providing patients the highest level of evidence-based, medically necessary care, than you can defend why it is needed for the patient in front of you. You can defend why it is not routine, that it is not just a part of a protocol; rather, for the patient in front of you, it is needed to diagnose or treat their condition. We should feel comfortable charging patients privately for items or services that are not covered. I hear people talk about how poor reimbursement is, and how audiologists are not getting paid for goods or services. There are many things that are non-covered that are very valuable to the patient. Something may be non-covered for statutory reasons, or because there is no code to represent it, or because it is experimental, but that doesn't mean that the patient does not need it. We need to feel comfortable in our value and the value to the patient in what we're providing, and charge people privately. I know audiologists all over the country, regardless of socioeconomic level in their community, regardless of whether they're in-network or out-of-network, that do collect payment for non-covered services. I know audiologists that do not participate in insurance other than Medicare. It's all about showing the value of your services to your patient.

Medical Necessity

It's really important to talk about medical necessity. I will give you the Medicare definition of medical necessity, because every insurance contract that I read as part of my work, talks about medical necessity. Every single one of them states that they cover what is medically reasonable and necessary. Medicare has very defined rules. A good rule of thumb is, follow the Medicare rules and you are probably going to meet the medical necessity requirements of every payer. Medicare defines medical necessity as: “Health care services or supplies needed to diagnose or treat an illness or injury, condition, disease, or its symptoms and that meet accepted standards of medicine.” This definition can be found at www.medicare.gov.

The service must be consistent with the symptoms of the illness or injury, be provided within generally acceptable professional medical standards, not performed for the convenience of the patient or physician, and furnished at a safe level and in a setting appropriate to the patient’s medical needs.

According to the Medicare Benefit Policy Manual, Chapter 15, Section 80.3, Medicare does not cover testing when the type and the severity of the current hearing, tinnitus, or balance status needed to determine appropriate medical or surgical treatment is known to the physician before the test. This is why they don't cover annual tests or routine testing unless the patient has a change in history or symptom and there is a physician order and medical necessity. They also do not cover testing that was ordered for the sole purpose of fitting or modifying a hearing aid. Those tests are the financial responsibility of the patient.

Medical necessity is clearly defined for audiology in the CMS Manual System; Transmittal 84 provides further detailed Audiology policies for Medicare. More information can be found at this link, but keep in mind that links may change.

Some examples of medical necessity are: if the patient reports a change in their hearing, tinnitus, or balance, and you have never tested them in their lifetime to determine the cause of their hearing, tinnitus, or balance issue; or, the patient has a condition that needs to be monitored (such as recurrent otitis media, cholesteatoma, mastoiditis, an acoustic or vestibular schwannoma, they are taking ototoxic medications, etc.). It’s important that medical necessity is needed for each individual procedure. For example, does every patient need tympanometry? Does every patient need otoacoustic emissions? You need to be able to document in your medical record why you did what you did, and why each of those tests result in payment. You need to be able to defend why the procedures you did were medically necessary for the patient in question. Overutilization can be easily seen, which I will demonstrate shortly. You need to be able to defend all of the procedures you performed and why you performed them.

I want to also stress one more thing. A thorough report to the ordering, attending and/or managing physicians, or to all of them, is the very best form of marketing. A good report that explains why you did what you did, what the results were, and your plan of care is very important to referral sources. That is why it's important for us to think beyond the ear and beyond amplification, and to look at the whole patient. Here are a few examples: a patient has tinnitus that may be related to their medication, so you indicate this and refer back to the physician for medication management. Or, a patient has a history of noise exposure, they still work in a noisy environment, and you recommended ear protection. Here is another example: A patient has a hearing handicap as evidenced by their score on a hearing handicap inventory, but test results show normal hearing. Your report indicates that the patient is not a candidate for a hearing aid but you recommend communication strategies, aural rehabilitation, or an assistive listening device. The plan of care goes beyond the audiogram and device, and documents why you did what you did, and the next steps. That is how you are compliant. That is how you avoid being a target of a purposeful audit, how you defend yourself if you are audited, how you build a great reputation among your referral sources, and how you differentiate yourself in the marketplace.

Your Medicare Data is Public

Your Medicare data is all publicly available. The Wall Street Journal provides access to your Medicare billing data at: https://graphics.wsj.com/medicare-billing/. You can actually search the entire profession of audiology; it will start with the number one biller of audiology services in the country, and work its way down. It shows the percentage for each procedure, and what percentage you are in the country of utilization of that procedure. The number two person on that list in audiology is in federal prison for Medicare fraud. I mention that to emphasize that it is very important that you know what your data looks like, and that you can defend everything that is on your profile. This information is very readily available and it was widely publicized when this link came out. The data is available for any Medicare billing provider because there was a data dump with the Freedom of Information Act request that the data be made public because of public dollars that are being spent.

Common CPT Coding Issues

Let's talk about some CPT coding issues. As I looked through the data dump, and as I hear things from Medicare, these are some things that we need to stress to providers in the audiology community. Here are the codes that are in the crosshairs.

Evaluation of Aural Rehabilitation (AR) Status

The first are codes for evaluations of aural rehabilitation (AR) status:

92626: Evaluation of auditory rehabilitation status; first hour

92627: Evaluation of auditory rehabilitation status; each additional 15 minutes (list separately in addition to code for primary procedure)

I’m going to reword code 92626 and say it is evaluation of AR status, 31 to 60 minutes. The reason is because to utilize this code, you need to have spent at least 31 minutes on medically necessary procedures; 92627 is for each individual 15 minutes after the first 60. To use this code set you should document your start and end time, and ensure you are performing procedures that are medically necessary. For a third party to cover these codes, they should be used for pre- and post-implantation testing of auditory prosthetic devices. Remember, Medicare and many insurers do not pay for testing related to a hearing aid. If you want to use these codes for AR for a hearing aid patient, you can, but then the patient would be responsible for the cost of that procedure. These codes are not for coverage for the QuickSIN or any routine hearing aid testing. I strongly advise you not to submit this code for coverage, unless you are doing pre- and post-cochlear implant or auditory prosthetic device such as a BAHA or auditory brain stem implant. You can defend that, as those are devices that have been deemed medically necessary by Medicare, Medicaid and most private payers and they are things that they cover. In summary, for coverage, this code has very limited uses. If you want to use it otherwise, the patient is responsible for the cost.

Otoacoustic Emissions

Otoacoustic emission (OAE) testing is not warranted in every test scenario. The rendering provider must be able to document that otoacoustic emissions testing is medically necessary for a specific patient.

You should not have a standard protocol for each and every patient where you conduct an audiogram, tympanometry, acoustic reflexes and OAEs. That is a real red flag to a payer for audit. The rendering provider must be able to document that OAEs are medically necessary for the specific patient. So let's look at the otoacoustic emissions codes as they are in the crosshairs of payers because of extreme increases in overutilization.

CPT code 92587. 92587 is “Distortion product OAEs, limited evaluation (to confirm the presence or absence of hearing disorder, 3-6 frequencies) or TEOAEs, with interpretation and report.” I’m going to reword this a little bit. This code is for when you performed 3 to 11 frequencies in both ears; 3 to 11 distinct frequencies are measured with transient or distortion product OAEs. You have to interpret the results of the test and write a report - it cannot be a pass/fail paradigm and your report should not indicate pass/fail. If it does, then you didn't qualify for interpretation as you did an automated interpretation, and you wouldn't qualify for use of that code. It is very important that you make sure your equipment is set up for you to interpret the results, that you actually interpret the test in your records, and that you write a report. These codes require a report.

CPT code 92588. This code is “Distortion product evoked otoacoustic emissions, comprehensive diagnostic evaluation (quantitative analysis of outer hair cell function by cochlear mapping, minimum of 12 frequencies), with interpretation and report.” This is a much more extensive test that involves at least 12 distinct frequencies in the right ear and at least 12 distinct frequencies in the left ear, and interpretation of the test and a report in the patient’s record. This test is indicated for, but not limited to, baseline and cochlear ototoxicity monitoring, cochlear mapping, to verify cochlear vs. non-cochlear function, and to verify functional hearing loss. There is a lot of equipment out there that does not do this procedure, and yet people are still billing for it. It is a diagnostic otoacoustic emission, a cochlear mapping. You need to document why you did this procedure, versus 92587. You need to use these codes when they're medically necessary, and use them appropriately, interpret them yourselves, and write a report.

Acoustic Reflexes

There is a lot of inappropriate billing when it comes to acoustic reflexes. It's appropriate to bill for acoustic reflexes (CPT code 92568: Acoustic reflex testing, threshold) when you perform both ipsilateral and contralateral reflexes on both ears for at least two frequencies. If you're only performing ipsilateral reflexes, you must append with a -52 modifier to show a reduced service. An ipsilateral acoustic reflex screening at 1000 Hz does not meet the coding criteria of billing for acoustic reflex testing; this is a screening. Screenings are non-covered. Again, in order to appropriately bill for acoustic reflexes, you need to have done ipsilateral and contralateral acoustic reflex threshold testing in both ears, for at least two frequencies. If you did not do ipsilateral and contralateral reflexes in both ears for at least two frequencies, and if you did not establish threshold, you cannot use the code at all. If you establish threshold, but only ipsilaterally, you have to append your coding. Or, if you test only contralaterally, you have to add the -52 modifier. Like OAE testing, acoustic reflex testing is not warranted in every test scenario. The rendering provider must be able to document that the acoustic reflex testing was medically necessary for that specific patient. I cannot stress enough that payers do not pay for your protocol. I also cannot stress enough that the ordering provider does not determine what is done. In an audit, it will be the rendering provider - you, the audiologist – who is responsible for the medical necessity. If you came back and said, "The ordering physician told me to do it", they would say, "Too bad - you are responsible to document what needed to be done and why it needed to be done." It is extremely important that you only perform testing that is medically necessary for the patient in front of you, and that you document that.

Speech in Noise Testing

The speech in noise testing code is probably the most heavily-abused code. Speech in noise testing can be included in a Comprehensive Audiological Evaluation (92557), or as part of Speech Audiometry with Speech Recognition (92556) evaluation. Or, it could be billed as an unlisted otorhinolaryngological procedure, 92700, with documentation and explanation of this procedure. This code should not be filed to Medicare if utilized as a predictor of hearing aid performance in noise, either pre-dispensing or post-dispensing. Medicare does not pay for anything related to a hearing aid. The patient would be financially responsible for the cost of this testing if it were performed for the purpose of hearing aids. Speech in noise testing should not be billed as a Filtered Speech Test (92571), as this code is one component of a comprehensive central auditory processing evaluation. 92571 is a completely inappropriate code to use for speech in noise testing. 92571 became part of a National Correct Coding Initiative (NCCI) edit by the Centers for Medicare and Medicaid Services (CMS) and was bundled with CPT codes 92572 (Staggered Spondaic Word Test) and 92576 (Synthetic Sentence Identification Test) into CPT codes 92620 and 92621 (Evaluation of central auditory function test, first 60 minutes and each additional 15 minutes, respectively).

If you want to bill speech in noise testing in isolation, it can only be billed using 92700.

Codes to Use with Caution

Audiologists all over the country are billing these procedures. Just because you're getting paid doesn't make it okay; actually, that makes it worse. If you are billing these procedures, it is important that you are actually performing the procedure that you're billing for, and that your documentation shows why it was medically necessary for the patient in front of you. Codes to use with caution include:

- 92504: binocular microscopy. You have to have an operating microscope to bill this code, and you have to have the medical necessity to do it. You cannot use this code because you want to remove cerumen, because cerumen removal is non-covered if provided by an audiologist in the Medicare system.

- 92560: Bekesy audiometry, screening

- 92561: Bekesy audiometry, diagnostic

- 92562: Loudness balance test, alternate binaural and monoaural

- 92564: Short increment sensitivity index

- 92571: Filtered speech test

These are codes that I have seen audiologists bill, and sometimes bill prolifically, but they ultimately weren't actually providing these procedures, or they were providing the procedure but it wasn't medically necessary for the patient in front of them. In an audit, you will be judged by a peer, oftentimes another audiologist, or a physician, or a nurse. When they look at the documentation, they need to make sure that it is clear why you did what you did.

Considerations for Using Code 92700

There are a lot of things we do that do not have a code to represent them. Instead of trying to throw something into a code that it really wasn't intended for just to get payment, I strongly recommend you use 92700 (Unlisted Otorhinolaryngological Service or Procedures) instead. This code can be used to classify procedures that don't have a CPT code. They're individually reviewed. The ABN (Advance Beneficiary Notice) would be required for traditional Medicare. Also, the ABN lets you collect payment at the time of service for these procedures, which is what I would strongly recommend that you do. Typically, these procedures are non-covered, and the patient is responsible for the cost. If reporting 92700, typically you will submit it electronically, and then they're going to kick it back for additional documentation. When you send additional documentation, submit a copy of the Patient Report, and a separate sheet of paper that includes a description of the procedure, the clinical utility of the procedure, the average time it takes to complete the procedure, the skills of the tester (that is, that it can't be performed by a technician), the equipment used, and your usual and customary fee. I used to have these already written up and in a file, and our biller would pull them out when these codes came through. In my experience, they are covered 20 to 30% of the time. When they are not covered, the patient is financially responsible for the cost. That is why you want to collect payment at the time of the visit after the patient completes the ABN. ABNs are only valid for traditional Medicare. They are not even binding for Medicare Advantage, Medicaid, or any private insurance. You would have to create a separate notice of non-coverage, or in the case of Medicare Advantage, go through their organization pre-determination processes.

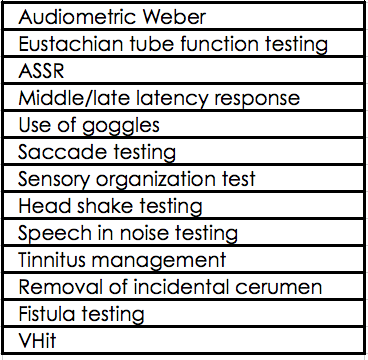

Table 3 lists some common procedures that would be represented by 92700.

Table 3. Common uses for 92700.

VEMPs is in CPT Assistant. The American Medical Association owns the codes and their uses, and they determined that the most appropriate code for VEMPs was 92700, and not 92585. Filing 92585 for VEMPs would be a false claim.

Third Party Administrators (TPA)

Third party administrators are becoming more prolific in the audiology space. A third party administrator is an entity between the employer or the insurer, and the provider, that negotiates specific discounts or a specific process to deliver, cover, or discount care. There are many third party administrators in our space such as Amplifon, TruHearing, Epic, Hearing Care Solutions, AudioNet, Arizona Hearing Network, and American Hearing Benefits. I know there's going to be a big new push of third party administrators entering the space in 2017. Third party administrators, as someone who used to work for one, exist to allow payers a single point of contact in payment for hearing aid related items and services. It defines the risk to the payer, especially if there is a funded benefit. “Funded” means the insurer is paying in whole or in part for a portion of the hearing aids. Third party administrators offer cost containment to the member, so the member has a very defined amount of out of pocket options. They can't upgrade into where they're paying out of pocket $5000 or $6,000; they have a very defined maximum for out of pocket costs in these scenarios, as does the payer. It also establishes a standard of care. Audiologists helped create the need for these programs because we were having so many patients upgrade rather than offering them things within their benefit. We were billing insurance in excess of what we were billing private pay patients. We helped create the need for third party administrators and we help to maintain their existence as we sign up and continue to participate.

I have some considerations I would recommend you review before agreeing to participate in such a program. Have you done a revenue analysis of participation versus non-participation? If you don't participate, how many patients, dollars, and referral sources does that account for? If you don't participate, will you lose all of those patients, and all of those referral sources and all of those dollars? You really need to do an analysis of each of these plans. Is the plan offering a funded or unfunded benefit? In other words, is it a straight discount program where the patient pays everything out of pocket, or is the insurer paying in whole or in part for the cost of the devices? That makes a difference between whether or not you can create your own competitive option. Is your practice bundled or unbundled? Most of these third party administrators now are itemized. That means that they have a very defined amount of visits, and after that, the patient is responsible for the cost of the services. If you are itemized, you might be able to create a competitive offering and not join, especially if the program is a straight discount program. Your practice would need to have access to a value-based hearing aid option in order to keep your cost of goods low to be able to compete. It is very important to conduct an analysis. We need to stop just signing these agreements as a reaction out of fear. We need to do an analysis for our business of what the pros and cons are, and look at it on paper before we jump in with both feet. How many patients do you stand to lose if you don’t join, and how will non-participation affect your referrals? Can you bind together and go to that payer or employer and create your own competitive program, either with your own practice, or with the other providers in your community? That is something that I think audiologists need to start to consider, especially if they're finding that their patients are not happy with the offering they're afforded through a third party administrator.

Food and Drug Administration (FDA) Guidance on Medical Clearance and Medical Waiver

The FDA guidance on the medical clearance and medical waiver recently changed. This is a quote from the FDA’s news release on this change: “The agency issued a guidance document explaining that it does not intend to enforce the requirement that individuals 18 and up receive a medical evaluation or sign a waiver prior to purchasing most hearing aids. This guidance is effective immediately.”

Here is a link to the press release, and a link to the guidance itself.

I want to stress today that before removing the issuance and completion of these forms from your practice, please consult your state hearing aid dispensing boards, in writing, for guidance as it relates to dispensing in your state. This is a dispensing issue, not an audiology issue, so start with your dispensing boards, and do it in writing. Tell them what the FDA has stated, send them the links, and ask how it impacts you as a dispenser in the state. This has no impact on the requirements that any third party payers, specifically Medicaid or Worker's Comp, may have for requiring medical clearance prior to obtaining amplification. They may require medical clearance not because of the prior FDA requirement, but as a gatekeeper or coverage requirement since they pay for things, especially in the Medicaid system. For specific guidance on how this change may impact any programs that you participate in, please contact the payer source in writing. Ask them if this has any impact on your need for those types of documents (medical clearance, medical waiver) in your payment arrangements.

Questions and Answers

Where can I find official word that audiologists do not need to participate in PQRS reporting in 2017, to show to my office manager?

It is in the final rule of the MIPS program, the Merit-Based Incentive Payment System, where it shows that audiology is an ineligible provider until 2019. Go to cms.gov and look at Medicare, Merit-Based Incentive Payment System final rule for 2016, search the document for audiology, and you will find that we are on the ineligible list.

What do you do when an insurance company demands a letter of medical necessity to cover the cost of hearing aids?

In that case, you write a letter of medical necessity that explains why those hearing aids are medically necessary for the patient in front of you to participate in their own healthcare decisions and in the quality of life. In my experience, especially when the patient's coverage is linked to accident, illness or injury, you should write a letter of medical necessity, and the physician should write one as well.

Can you recommend amplification on a physician report?

Yes. The fact that amplification is an outcome does not make testing non-covered.

If a patient is insisting they want an annual hearing test, and they have Medicare, do you bill Medicare and let it be denied, or do you have the patient pay out of pocket at time of service and not bill?

If I had a patient insisting they wanted to bill Medicare, we have to do that, because we're a mandatory claim submitter. I would have that patient sign an ABN. The ABN that they sign would say that that you do not think Medicare will cover the test, because it's not medically reasonable or necessary. If they selected option one, you would bill it with a GY modifier. I would have the patient pay at time of service, because a GY or GZ modifier will drive a denial. You would absolutely bill it if they want you to, but I would have them sign an ABN in that situation. The ABN would clearly explain that it's not medically necessary. You can have that the ABN also say that they can be financially responsible, and then you would bill it with a GY or GZ modifier.

Citation

Cavitt, K. (2017, February). Coding and reimbursement update for 2017 & beyond. AudiologyOnline, Article 19206. Retrieved from https://www.audiologyonline.com.